The global Coronavirus pandemic is an unprecedented experience for Americans alive today. It’s natural to feel a lot of anxiety about the future, including the future of your portfolio. Luckily, market volatility is not unprecedented. In this article, we’ll apply the lessons of previous market downturns to help you develop a sensible economic outlook for whatever stage of life you’re in now. Have questions? Contact one of our Virginia-based Financial Advisors today.

Long-Term Financial Goals in your 20’s and 30’s

In this stage of life, you have the power to take the long view and buy low, which will help you take advantage of upswings when the market inevitably turns around. In general, you want to buy less when the market is high and more when it’s low. This is when you are most likely to benefit the most from compound interest.

Start Now

Whether you’re just out of college, building your career, or married with kids, now is the time to get your finances in order and put a financial plan in place. Even if you can’t afford to save much right now, whatever you can put into your investment accounts will benefit you in the long run. You can reduce total interest paid on debt, benefit from flourishing markets, and be financially prepared for unexpected emergencies or expenses.

- Open a retirement account if you don’t already have one. If you don’t qualify for an employer sponsored plan, you can open your own Individual Retirement Account (IRA).

- Boost your emergency savings. Start with a manageable goal like $1,000 and work your way up to a month of living expenses, then a few months.

- Pay down debt. If you have credit card balances, start with the lowest one and throw a little more at it each month until it’s gone. Then tackle the next-highest balance. If you don’t have credit card debt, look at student loans or a car loan. The sooner you can pay off these debts, the more money you’ll be able to save.

Invest For The Long-Term

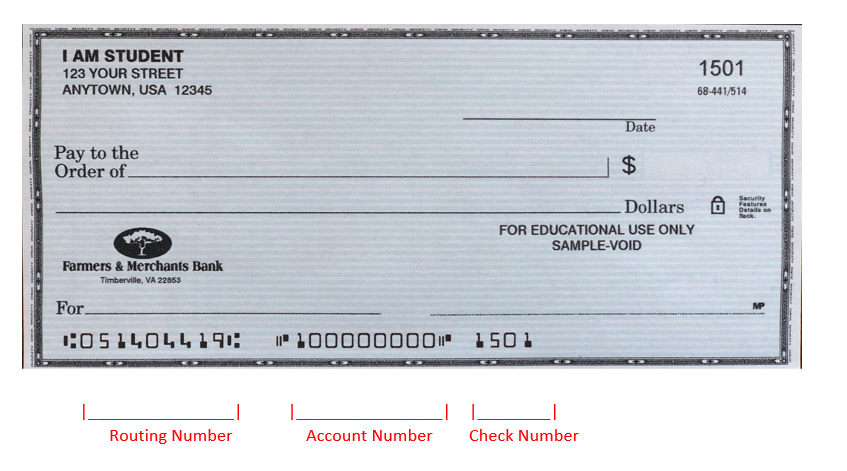

Set aside three to six months’ salary in a savings account for a rainy day. This will come in handy if you lose your job as well as for unexpected expenses and emergencies like a trip to the ER or a big car repair. Keep your emergency funds in cash in an FDIC-insured savings account.

- Take advantage of compound interest as soon as you can. Earn interest on the interest you receive by adhering to a disciplined investing plan.

- Don’t make any drastic financial changes right now if it’s not necessary. Instead, focus on saving aggressively and putting any extra money towards retirement.

- Keep savings in cash or CDs so the funds are readily available for any significant expenses or purchases you will make in the near future.

Practice Dollar-Cost Averaging

This is an investment strategy* in which assets are purchased regularly at a fixed dollar amount. For example, 401(k) plans use dollar-cost averaging by making regular purchases according to the participant’s pay schedule and contribution. As a result, investors could end up buying certain investments at a discount during periods of market underperformance.

*Dollar-cost averaging is a method of helping to control risk. It does not assure a profit or the avoidance of loss. Investors should consider their ability to continue a dollar-cost program in periods of declining markets.

In Your 40’s and 50’s, Get Out Ahead Of Market Volatility

This life stage includes the prime income-earning years when you’re likely to have the greatest savings power. Stash away as much cash as possible while it still has a few decades to compound.

Start Diversifying With Safer Investment Options

Diversify your portfolio* info safer investment options such as bonds, bond mutual funds, CDs, and Money Market Accounts. These options tend to be more stable as markets change, helping to protect your portfolio from dramatic ups and downs.

*Diversification is a method of helping to control risk. It does not assure a profit or the avoidance of loss.

Consider Additional Principal-Protecting Options

Consider an annuity or a life insurance policy, especially if you have a family that is dependent on your income. The younger and healthier you are, the more likely you are to qualify for a lower rate.

In your 60’s and Through Retirement

Now it’s time to create a more risk-averse investment strategy.

For those nearing or already entered into retirement, it’s essential to protect the assets that will carry you through the entirety of retirement. The best approach is to set up three buckets of investment money that can financially carry you through each phase of your retirement:

- 5-Year Bucket: Short-term income to fund immediate needs.

- Intermediate Bucket: This is for money invested in a moderate-risk portfolio that can continue to grow over the next 6 to 15 years.

- Long-Term Bucket: Finally, you have money that can be aggressively invested and won’t be touched for 16 years or more.

Build A Retirement Budget

The amount of money you need to live on in retirement depends on how much you’ve saved so far and what a “comfortable life” looks like for you.

Start by making a list of your current expenses. Include both fixed bills, such as housing costs, as well as discretionary spending for items like clothing, travel, entertainment, and so on.

How much of your salary are you living on now?

If you’re spending close to all of what you make now, it’s a good idea to “test run” your retirement by trying to scale back and only spend 70 percent or so of your income. Yes, you may drop some expenses in retirement (less spending on transportation, a paid-off house to live in) but other costs of living could rise (healthcare, property taxes). And if you want to enjoy travel, classes, and other leisure/enrichment activities that aren’t free, you’ll probably spend more on that in retirement and need to budget accordingly.

Have you saved enough?

A number of factors (some out of your control) will determine how much yearly cash your retirement savings provides. If you don’t feel like you have enough, don’t get dejected. Just keep focusing on saving. You can, on average, double your nest egg balance in the last ten years or so of your career. People age 50 and older are even permitted to make larger “catch-up contributions” to 401(k) plans and IRAs.

Seek Out Other Income-Producing Assets

The more streams of income you have, the better your overall financial stability will likely be. For example, many retirees take on part-time jobs to supplement their savings. This could relate to a passion or hobby, such as working in a garden store if you love plants, or teaching a class at the local community college to share your expertise from a long career.

Also consider income-producing assets such as real estate/investment properties, dividend-paying stocks, and/or variable annuities.

Best Practices For All Life Stages

- Don’t make any spontaneous decisions or changes. Talk to your financial advisor to discuss your financial goals and concerns before making any rash decisions, especially decisions related to retirement savings or investments.

- Don’t make early withdrawals. If you take an early withdrawal from your 401k before age 59.5, you’ll pay ordinary income taxes and a 10% penalty. Withdrawing money early also forfeits tax-advantaged growth and can trigger a higher tax bill.

- Get a financial planner. Professional financial managers can help you navigate the market turbulence and prevent you from making detrimental financial decisions during market volatility.

- Reassess and rebalance on a regular basis. Whether it’s quarterly, semiannually, or annually, make a standing appointment to review your investments and assets to ensure your finances are where you want them to be.

F&M Bank’s Osaic Institutions Investment Executives Can Help You Navigate the Market!

Whatever stage of life you’re in, our financial planners can help you understand your options and develop a strategy for your investment portfolio that matches your individual goals for retirement. Feel free to reach out with any questions you may have or schedule a consultation with an Osaic Institutions Financial Advisor at any of our locations in Staunton, Harrisonburg, and the greater Shenandoah Valley.

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. F&M Financial Services is a trade name of F&M Bank. Osaic Institutions and F&M Bank are not affiliated.

Securities and Insurance Products:

Not Guaranteed by the Bank | Not FDIC Insured | Not a Deposit | Not Insured by Any Federal Government Agency | May Lose Value Including Loss of Principal