Archive for year: 2020

Watch out for Corona-Criminals

In a time of uncertainty and isolation we are all reaching for more information, especially from respected institutions such as the Centers for Disease Control (CDC), the World Health Organization (WHO) and respected hospitals and research facilities. But unfortunately cybercriminals are using the names of these institutions to lure unsuspecting individuals into fake offers, giving out personal information, and clicking on download links that can infect their computers. This can lead to fraud, identity theft and the loss of account information and passwords. As with all things related to the coronavirus outbreak, it pays to be vigilant.

In short, if you have accessed an online article, blog, or website that is not familiar, and you don’t feel 100% safe, do not click on offers or download documents, interactive maps or programs. This may be an attempt to introduce a malicious computer virus, ransom-ware or other program into your phone, tablet or PC for the purpose of collecting your personal information. If you click on a link and you are asked for permission to download, or give access to your photos, contacts, etc., think twice. Do you really understand what this program or app is going to do with the information you are providing? Like the coronavirus we need to be very careful about the things that we virtually touch and what we allow to touch us!

See below two recent articles from the Federal Trade Commission about coronavirus scams:

Avoid Coronavirus Scams

Types of Coronavirus Scams

As always, if you feel that you might be a victim of identity theft or you have a question about the safety of your accounts or your login information please contact us. We can help.

Local Business Profile – Blueline

If you’ve lived in the Valley for any length of time, you’ve probably heard of Blue Ridge Architects. And if the name isn’t familiar, you’ve definitely experienced their work. A long-time Downtown Harrisonburg resident, Blue Ridge Architects — recently rebranded as “Blueline” — was founded 15 years ago and has had a hand in designing and building such prominent Downtown fixtures as Turner Pavilion, the Friendly City Food Co-Op, and the JMU wing of the Ice House building.

In December of 2018, Blueline faced the challenge of adding 5 to 7 professional designers to keep up with demand for its services. With notable projects underway from Ohio to Georgia, adding staff one at a time was going to make it difficult to train and integrate new team members efficiently while meeting looming deadlines. In March of 2019 Blueline CEO Randy Seitz AIA, received an email from a mergers and acquisition broker highlighting a firm in Houston Texas with a staff of 7, a strong backlog and specialty in churches — just what Blueline needed. As Randy and Vice President Anna Campbell, AIA entered into conversations with Turner Duran Architects, they found a firm with solid technical experience, a striking portfolio and dedicated team looking for continuity and new opportunities. More importantly, their clients described a firm that operates with the same values as Blueline — Honor, Humility and Generosity.

By October 1, 2019, the deal was finalized and Turner Duran became part of the Blueline team. Adding Jack Duran AIA and his team to the firm provides both immediate capacity and a giant step towards the goal of providing turnkey project building delivery services to purpose driven organizations nationwide. To get a better sense of how this “blended” firm can help you plan and build a facility that amplifies your mission and purpose, visit www.blueline.team

Would you like your local business to be featured in our monthly newsletter? Email marketing@fmbankva.com for more information!

F&M Bank Appoints Rick Williams and Roger Decker to Board

F&M Bank is excited to announce the appointment of Rick Williams and Roger Decker to the F&M Bank Augusta County Community Board.

Rick Williams boasts over thirty years in the insurance industry and currently owns and operates R G Williams Insurance Agency, Inc. His broad knowledge of insurance coverages, risks and exposures, as well as his experience working in Virginia government, allows him to serve his insurance clients with unique expertise and insight. Rick handles all farm, business and life insurance coverages for agency clients.

Mr. Williams is an active community member and currently serves on the Buyer’s Committee for the Augusta County 4H/FFA Market Animal Show as well as a Director for the Waynesboro Heritage Foundation and Museum. He is currently serving on the Augusta County Agricultural/Forestal District Advisory Committee. Rick and his wife, Diane, have been life-long residents of the Shenandoah Valley and currently reside in Stuarts Draft.

Roger Decker has worked in the real estate industry since 1987 and currently owns and operates Decker Realty in Staunton with his wife, Monya. Roger specializes in the sale of farms and land in the Shenandoah Valley and is typically a top seller of farms in Augusta County. Both he and his wife recently achieved the coveted GRI (Graduate Realtor Institute) designation.

Prior to moving to Virginia from Pennsylvania, Mr. Decker worked as an HVAC designer for four years. He then began working for his family’s real estate development business for seven years. Roger returned to school, received his Bachelor of Science from James Madison University and entered the building industry in Virginia as a Class A contractor. Mr. Decker has been a licensed realtor since 2002 and broker operating his own office since 2009.

It’s Not True Love if They Ask for Money

Article from FTC website, by Cristina Miranda; Division of Consumer and Business Education

It’s almost Valentine’s Day. Lots of people have profiles on online dating sites, apps or social media to find “the one.” But that interesting person who just messaged you could be a sweet-talking romance scammer trying to trick you into sending money.

Reports of romance scams are growing, and costing people a lot of cash. According to new FTC data, the number of romance scams people report to the FTC has nearly tripled since 2015. Even more, the total amount of money people reported losing in 2019 is six times higher than it was five years ago – from $33 million lost to romance scammers in 2015 to $201 million in 2019. People reported losing more money to romance scams in the past two years than to any other fraud reported to the FTC.

In a sea of online profiles, romance scammers can be hard to detect. But, there are signs you can look out for. Romance scammers start by using someone else’s identity to create fake profiles. They’ll send you flattering messages to make a special connection, say all the right things, and gain your trust. They might claim to be a doctor, a servicemember, or an oil rig worker living overseas. They want to make future plans with you. But then, something comes up and they ask you for money to help them out. Which nearly always means asking you to buy gift cards (and give them the PIN, so they get the cash), or wiring them money.

Here’s the thing: Never send money or gifts to a love interest you haven’t actually met. It’s a romance scam.

- Stop communicating with the person immediately.

- Search online for the type of job the person says they have. See if other people have heard similar stories. For example, you could do a search for “oil rig scammer” or “US Army scammer.”

- Do a reverse image search of the person’s profile picture. If it’s associated with another name or with details that don’t match up, it’s a scam.

- Never wire money to a stranger, or pay anyone with gift cards. If someone asks you to wire money or pay with gift cards, report it to the FTC at ftc.gov/complaint.

For more information, read What You Need to Know About Romance Scams. And check out this video.

F & M Bank Corp. Announces Earnings

F & M Bank Corp. (OTCQX:FMBM), parent company of Farmers & Merchants Bank, announces its financial results for the fourth quarter and year ended December 31, 2019.

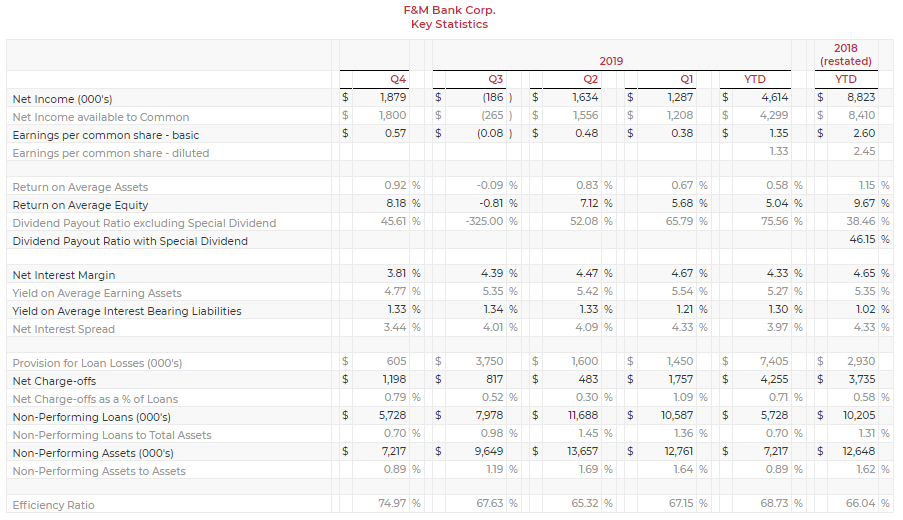

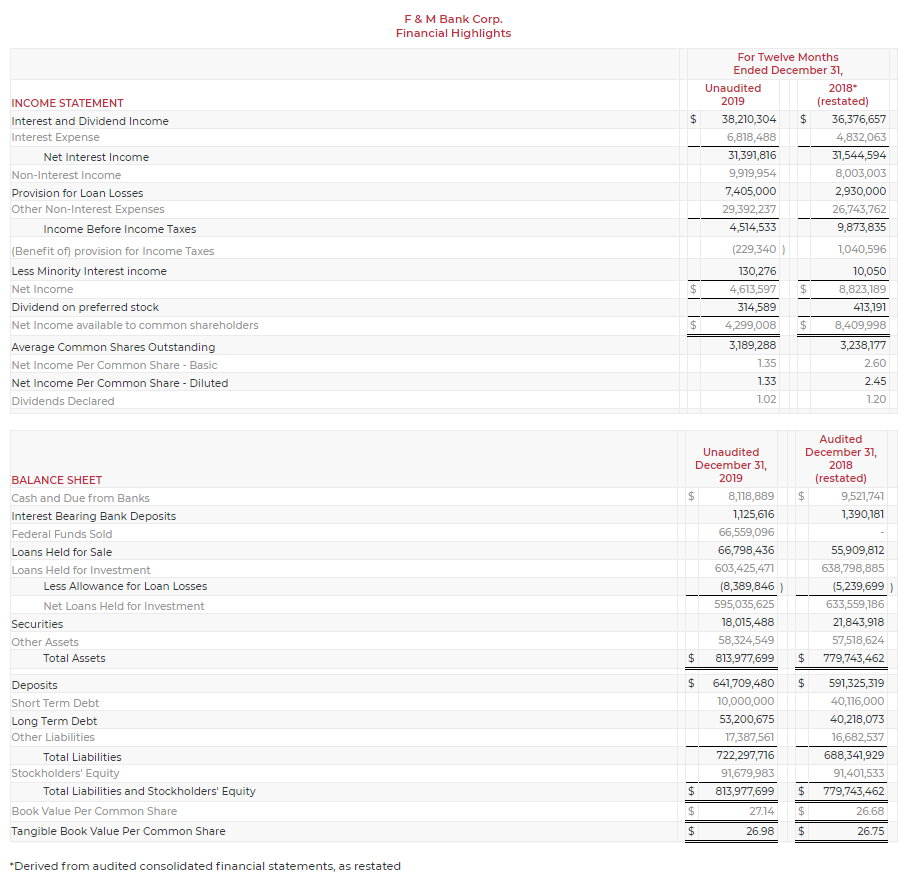

Selected highlights for the quarter and year to date include:

- Net income of $1.9 million and $4.6 million, respectively;

- Non-performing assets decreased $2.43 million during the fourth quarter and $5.43 million year to date;

- Net interest margin 3.81% and 4.33%. respectively;

- Total deposits increased $23.3 million and $50.4 million, respectively for the quarter and year to date.

Mark Hanna, President, commented, “We are pleased to announce fourth quarter and year-to-date earnings of $1.9 million and $4.6 million, respectively. Although these results are lower than prior year, we made great progress in positioning F&M Bank for continued success by substantially reducing our Non-performing assets and growing Core deposit relationships. It is important to note that Fourth Quarter earnings were reduced by several non-recurring items related to dealer deferred cost amortization, pension costs and severance benefits. Our margin decreased as a result of lower loan balances due primarily to sales of indirect dealer loans which occurred during the second half of the year and unrecognized dealer loan costs. Our provision for loan losses increased in 2019 due to higher levels of substandard loans and identification of problem credits. We feel the allowance for loan losses reflects the current risk in our loan portfolio. As we push into 2020, we feel that we are well positioned to leverage our surplus liquidity with organic loan growth and continued improvement in reducing our funding costs.

Hanna continued, “During the fourth quarter we made significant progress in addressing our problem assets. Previously we had announced that two large loans were placed on non-accrual during the second quarter, resulting in our significant allowance for loan loss funding in the first half of the year. During the fourth quarter we were successful in collecting on one of these loans and we recognized a partial write-down on the other based on the appraised value and continued payment delinquency. As a result of these and other collection efforts our problem assets decreased from $17.3 million to $12.6 million.” Highlights of our financial performance are included below.

Restatement of 2018 Financial Statements: In November 2019, as a result of the sale of a portion of the Bank’s indirect dealer loan accounts, management discovered a system input error that prevented the deferred costs associated with dealer loans originated after a certain date from amortizing properly. This error in accounting resulted in a restatement of calendar year 2018 earnings of $261,728, net of tax and a correction of $248,090, net of tax for years prior to 2018 which is reflected as a reduction to retained earnings in the restated 2018 consolidated financial statements. The 2019 earnings properly reflect the amortization, which resulted in reduction of earnings of $184,890, net of tax.

F & M Bank Corp. is an independent, locally-owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank’s fourteen banking offices in Rockingham, Shenandoah, Page and Augusta Counties, Virginia. The Bank also provides additional services through a loan production office located in Penn Laird, VA and through its subsidiaries, VBS Mortgage, LLC (DBA F&M Mortgage) and VSTitle, LLC located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-8941.

This press release may contain “forward-looking statements” as defined by federal securities laws, which may involve significant risks and uncertainties. These statements address issues that involve risks, uncertainties, estimates and assumptions made by management, and actual results could differ materially from the results contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in: interest rates, general economic conditions, legislative and regulatory policies, and a variety of other matters. Other risk factors are detailed from time to time in our Securities and Exchange Commission filings. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

- The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are nontaxable (i.e. municipal securities and loan income) then subtracting interest expense. The tax rate utilized is 21%. The Company’s net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns nontaxable interest income from municipal loans and securities, net interest income for the ratio is calculated on a tax equivalent basis as described above.

- The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. The efficiency ratio is a common measure used by the financial services industry to determine operating efficiency. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investment portfolio. The Company calculates this ratio in order to evaluate how efficiently it utilizes its operating structure to create income. An increase in the ratio from period to period indicates the Company is losing a greater percentage of its income to expenses.

CONTACT: Carrie Comer, EVP/Chief Financial Officer

540-896-8941 or ccomer@FMBankVA.com

F&M Bank Announces Officer Promotions

F&M Bank and its Board of Directors would like to congratulate the following individuals on their Officer promotions effective January 24, 2020.

Bank Officer:

Ann Kirtley, Elkton Branch Coordinator

Carrie Grimes, Timberville Branch Coordinator

Christy Trail, Woodstock Branch Coordinator

Emily Rhodes, Credit Analyst

Mary Pavlovskaya, Business Deposit Services Officer

Teri Hasley, Deposit Operations Manager

Assistant Vice President:

Ashley Lam, Crossroads and Grottoes Branch Manager

Jessica Fletcher, Dealer Finance Associate

John Coffman, Woodstock Branch Manager

Jordan Dean, Commercial Relationship Manager

Matt Hill, Commercial Relationship Manager

Vice President:

Calan Jansen, Infinex Financial Advisor

Matt Robinson, Infinex Financial Advisor

Sarah Prusak, Business Deposit Services Officer

Senior Vice President:

Natalie Strickler-Alt, Northern Area Market Manager

Sara Berry, Southern Area Market Manager

Paul Eberly, Agricultural & Rural Programs Leader

For more information, please contact Kelsey Dean, Marketing Specialist at (540) 217-6410, or email marketing@fmbankva.com.

F & M Bank Corp. Announces Dividend

F & M Bank Corp. (OTCQX:FMBM), parent company of Farmers & Merchants Bank, announces its recently declared third quarter dividend.

Mark Hanna, President, commented “On January 24, 2020, our Board of Directors declared a fourth quarter dividend of $0.26 per share. Based on our most recent trade price of $28.13 per share, this dividend constitutes a 3.70% yield on an annualized basis. The dividend will be paid on March 2, 2020, to shareholders of record as of February 14, 2020.”

F & M Bank Corp. is an independent, locally-owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank’s fourteen banking offices in Rockingham, Shenandoah, Page and Augusta Counties, Virginia. The Bank also provides additional services through a loan production office located in Penn Laird, VA and through its subsidiaries, F&M Mortgage and VSTitle, both of which are located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-8941.

CONTACT: Carrie Comer, EVP/Chief Financial Officer

540-896-8941 or ccomer@fmbankva.com