F&M Bank Announces Organizational Leadership Realignment to Support Continued Growth

Timberville, VA (June 30, 2025) -- F&M Bank has announced a strategic realignment of its leadership team, positioning the organization for its next…

F&M Bank Named Best Bank and Best Mortgage Company in the Valley

We’re honored — and thrilled — to share that F&M Bank has been named both Best Bank and Best Mortgage Company in the 2025 Best of the Valley…

Wire Transfer Standard Change Begins July 2025

A New Standard for Global Payments Begins July 2025

Effective July 14, 2025, a new messaging format—ISO 20022—will be adopted for wire transfers in…

Fraud Alert: Beware of Spoofed Calls Claiming to Verify Debit Card Transactions

Recent Scam Targeting Valley Residents

We have received multiple reports of customers receiving phone calls from 540-896-8941, with the caller posing…

Why Your Kids Should Have a Lemonade Stand

Nothing says summer like a good old-fashioned kids lemonade stand. It’s one of the best ways to teach money lessons for kids, while helping them build…

New Tariffs Drive Market Volatility

New Tariffs Drive Market Volatility

At 4:00 p.m. on April 2, 2025, President Trump announced sweeping tariffs on imported goods that were significantly…

There’s Still Time: What You Should Know About the IRA Contribution Deadline

There’s Still Time: What You Should Know About the IRA Contribution Deadline

As tax season approaches, so does an important opportunity to invest…

Don’t Just Open a Bank Account- FOCUS On the Right One

Opening a bank account might seem like a simple task, like grabbing a coffee – quick and easy. But it's a far more crucial step in managing your finances,…

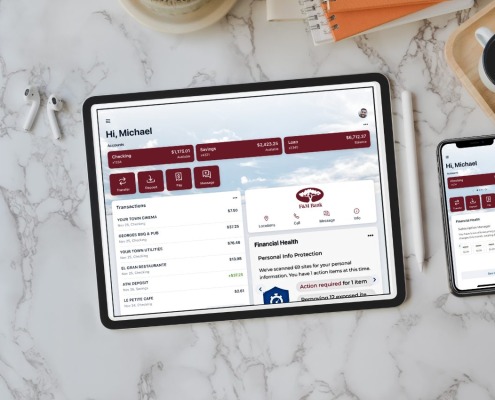

Introducing Financial Health Suite: Your All-in-One Money and Identity Protection Tool

At F&M Bank, we believe in constantly evolving our products and services to better serve our customers and strengthen our community in the Shenandoah…