Clean Up Your Credit Score

Whether you’re preparing to apply for a loan or reeling after a credit application rejection, if you are looking to improve your credit, you aren’t alone. According to Experian, about 30% of adults have scores of less than 670—the standard minimum for a conventional home loan approval. The good news is that credit scores are always in flux—and that means that your score can change for the better, with just a bit of effort.

In this post, we’ll give our best advice on how to fix bad credit, discussing tried and true credit repair strategies for short-term improvement and long-term gains. Keep reading to learn how you can clean up your credit score!

Understanding Your Credit Score

Firstly, knowing how credit scores work, what factors go into their calculation, and how your financial habits affect your score are all crucial to improving your credit standing.

What is a credit score?

A credit score is a numerical calculation based on your credit report—a history of your credit reported by a variety of creditors. These can include lenders, credit card companies, financial institutions, utility companies, and even healthcare providers. Credit scores take your payment information, as well as details about how long you’ve had accounts and how much debt you hold, and turns it into a number.

Ideally, your credit score is an accurate reflection of your tendency to pay back your debts. When paired with income data, it can help lenders make informed decisions about loan approvals. Major components of credit score calculation include your payment history, the amount of debts you owe/percentage of credit used on cards, and the length of credit history.

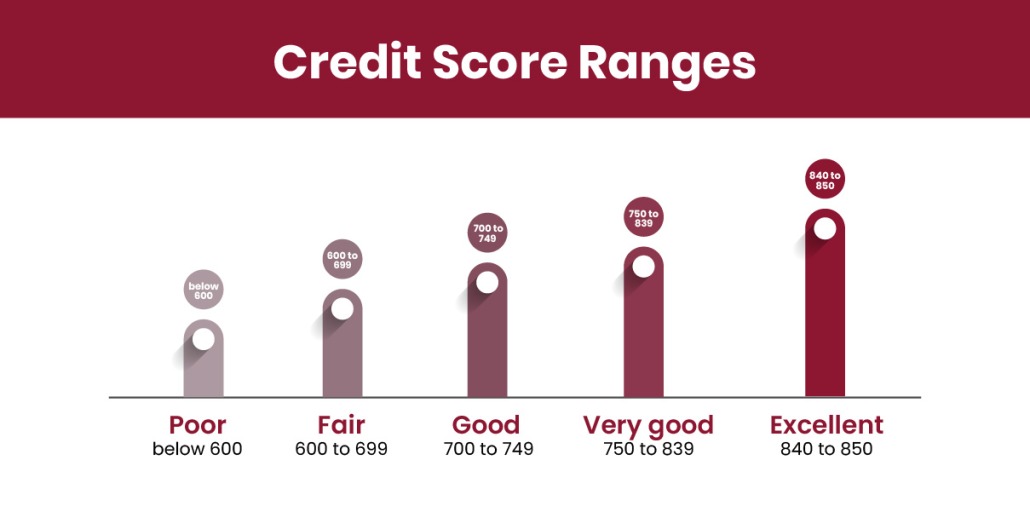

While there is more than one provider of credit scores, FICO is the most commonly used scoring system in the US. FICO scores range from 300 to 850, with scores above 800 being considered “excellent.”

What is a credit score used for?

Your credit score is used as an aid in determining:

- Credit card and loan approvals

- Interest Rates

- Insurance premiums

- Rental worthiness for homes and apartments

- Utility fees

Employers may also check your credit, especially if the job at hand involves financial tasks.

Assessing Your Credit Report and Score

Credit reports are available for free, and reading your own report can help you see where improvement is needed to elevate your score.

Where do you find your credit report and score?

While there are many paid services that offer to provide your credit report, score, and even credit monitoring, it’s not necessary to pay for your report.

At www.annualcreditreport.com you can request your report from each of the three main reporting agencies (Experian, Equifax, and Transunion) once each year.

While they generally contain the same information, there may be discrepancies. Requesting all three at once can give you the most definitive understanding of your credit picture. When rebuilding your credit or tracking your credit growth, you may wish to take an alternative approach. Requesting one report every four months or so can allow you to see changes in your credit history over time.

Credit reports can also be requested by phone or by mail:

1-877-322-8228

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

When requesting by mail, you’ll need to print and complete the form found on the annualcreditreport.com website. You will receive your reports by mail within 15 days of their receiving your request

Credit scores, on the other hand, are not available for free through this service. So how do you get them without paying?

- You can use the free version of credit monitoring services, such as Credit Karma, to have a good sense of your score (though it won’t be identical to the one lenders use)—but watch out for fees and upcharges.

- If you have a credit card, the credit card company may also provide a free version of your score in your online account or on your monthly statement.

- Lastly, if you apply for a loan or credit card, the company is required to provide you with the score they used to determine your approval. Request it if it is not automatically provided.

Ultimately, however, everything you need to know about improving your credit is available for free on your report.

Strategies for Credit Score Improvement

Now that you know how to obtain your credit report, how your your credit history is used to calculate your score, and how your score can affect different aspects of your life, it’s time to take a look at the methods you can use to improve your credit over time, as well as things you can do that will have the greatest immediate positive impact.

Long-Term Strategies for Good Credit

Good credit is a long-term process that requires constant engagement with responsible financial habits. Here are 5 things you can do to gradually build and maintain excellent credit and increase your chances of getting approved for a loan.

-

Pay your bills on time:

Your payment history counts for 35% of your credit score. Do your best to pay all accounts on time or as soon as possible if you miss a payment date—but never skip payments altogether. Bills paid within 30 days of their due date will not be reported, though any late payments may incur fees.

-

Regularly review your report and address issues:

Identity and credit card fraud often go unnoticed until an individual spots unusual activity on their credit report. And sometimes companies report issues erroneously. If you see something wrong, dispute the error right away.

-

Keep accounts open.

It may be tempting to close that old credit card, but the longer you keep accounts open, the better it is for your score.

-

Maintain a good mix of credit.

Having just one kind of credit can have a negative impact on your score. Having both revolving accounts (like credit cards) and installment accounts (like loans) is important, to show you are capable of handling both kinds of debt.

-

Build a savings cushion.

Not only will this prevent you from relying on credit in the case of an unforeseen circumstance, it will also show lenders that you have resources to lean on to ensure ongoing financial stability.

How to Boost Your Credit Score Quickly

If you’re hoping to apply for a loan in the near future or just looking to make the biggest immediate impact on your credit score, here are 5 steps you can take to raise your credit score quickly.

-

No credit? Bad credit? Get a secured credit card.

Lest you get a rejection in your application, it’s important to apply for a card that you will likely get approved for. A secured credit card from your bank, which uses an existing account for collateral, can be a great place to start with credit score building or rebuilding. But only open one new account at a time!

-

Become an authorized user.

An alternative way to build credit is to become an authorized user on a credit card account (a spouse or family member) with a high limit and good history. It’s not even necessary for you to use the account to receive this benefit.

-

Keep your credit utilization rate down.

Credit utilization is the amount of credit you used, vs. the amount available to you. For instance, a card with a $10,000 limit and a $2,500 balance would have a 25% utilization rate. Keep rates across accounts below 30%. To do so, either pay down higher balance and maxed out cards, or ask for a higher limit.

-

Pay off accounts in collections.

Once you get your credit report, you may see accounts in collections. These will have an outsized impact on your score. Getting accounts out of collections as quickly as possible will minimize their impact.

-

Start paying your bills on time.

Your most recent payment history matters more for your credit score calculation than your distant payment history. Start paying bills ontime if you have a pre-existing pattern of late payments.

Professional Credit Building Resources

Struggling to untangle credit problems? Not sure where to start? There are numerous national and local resources that can help you with your credit score repair. They include:

- Northern Shenandoah Valley Financial Education Program

- Southside Community Development and Housing Corporation Financial Opportunity Center

- Housing Opportunities Made Equal (HOME) of Virginia

- CCCS Maryland

- CESI Credit and Debt Resources

- National Federation for Credit Counseling

You may also want to consider using services like Experian Boost which can allow you to get credit for bills you pay on time that haven’t already been reported.

(Re)Build Your Credit with F&M Bank

At F&M Bank of Virginia, we want our customers to have the best chances to achieve their financial goals, whether it’s getting a good interest rate on a personal loan or buying their own home. And we know that good credit is integral to long-term financial success.

From low-interest credit cards to help you build your credit history to financial tools to protect your finances and prepare for the future. Questions about credit? We’re only a phone call or short drive away. Reach out to us at one of our branch locations throughout the Shenandoah Valley today.