Is Cash Still King? Digital Payment Services Are Increasing in Popularity

Is cash still king? If you’re like many Americans, the answer to that question is probably no.

According to a study conducted by the Pew Research Center, roughly 3 in 10 Americans say they make no purchases using cash during a typical week. For Americans who report that all, or almost all purchases are made using cash, the numbers are declining – from 24% in 2015 to 18% in 2019.

Debit, credit, and digital payment options have created a level of consumer comfort that has completely transformed the way transactions are conducted. Instead of relying on cash or checks, many consumers are turning to various forms of digital payment services.

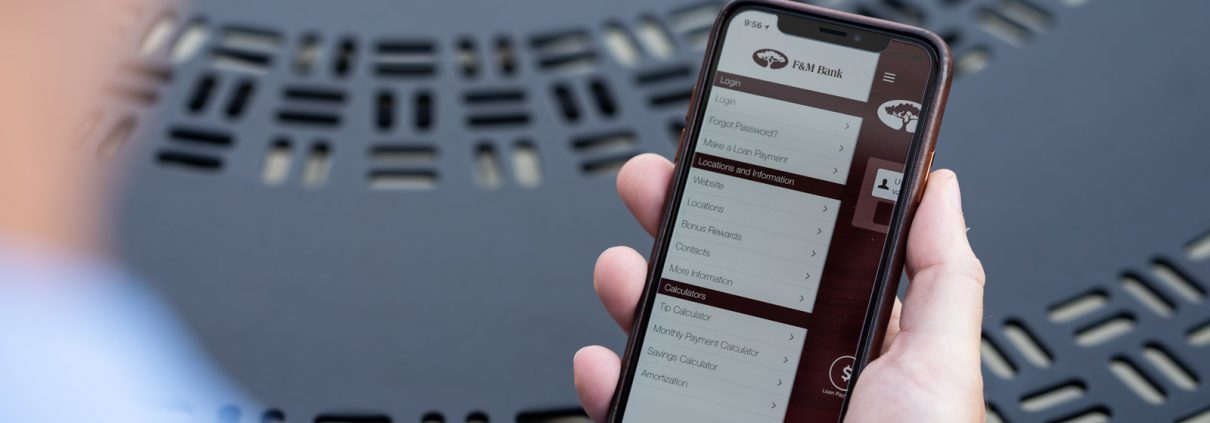

At F&M Bank, we recommend customers take advantage of our Person-to-Person Payment money transfer app, or as we call it, P2P.

What is P2P?

P2P is a mobile banking funds transfer app that lets you send money securely through your personal computer or phone. Simply type in the email address or phone number of the person you need to pay and send up to $500.00, for free! For the utmost in convenience, the recipient can bank with any financial institution. Here’s an example of how it works:

Your coworker is selling Girl Scout cookies for her daughter, and today is the deadline to order. You’ve resisted ordering for two weeks, but it’s been a stressful day and your salad from lunch didn’t do the trick. You reach into your wallet only to realize you have no cash, you never carry your checkbook, and the nearest ATM is a 15-minute drive from the office.

Luckily, you remember F&M Bank offers the P2P service. Instead of spending the afternoon sad and hungry, you visit the P2P website (or, mobile banking customers may visit the F&M Bank app), send payment and you’re now in Thin Mint heaven.

This scenario might be a little dramatized, but it truly is a real-life example of how one customer chose to use the app. P2P offers a convenient, alternative method for sending cash digitally in a variety of different situations. The service offers a timely, simple and secure way to pay.

It’s Timely

Mailing a check or cash can take days to reach your payee. Why wait that long? P2P payments are sent immediately, and if the payee selects to accept payment using their debit card number, payment is instantaneous! A payee may also choose to accept a payment using their deposit account number, but the transfer could take up to three days to process using ACH. The debit card method is preferred if you’re looking for a quick transfer!

One customer says, “I send my daughter and grandchildren money from time to time and use P2P. The money gets there much faster than sending a check! I love it and use it quite often.”

It’s Simple

P2P makes life easy. To send a payment, you only need to enter:

- Your Name

- Your Email Address

- Your Recipient’s Email Address or Phone Number

- Your F&M Bank Debit Card Number

F&M Bank wanted to make sending cash easy as easy as possible. We know geographical barriers can make a cash transfer difficult. Whether your family or friends live in a different town, or state, P2P offers a convenient solution.

A P2P user says, “My college friends and I get together each year for a reunion. We rent an Airbnb for a weekend and all split the rental fee. Since we’re all spread out across the state of Virginia and bank with different institutions, P2P is an easy and secure way for me to pay back a friend who banks somewhere else.”

Another user states, “I’ve used P2P to pay back my siblings who live out of state for our shared Netflix and Amazon Prime accounts!”

It’s Secure

The greatest benefit of P2P is the peace of mind it can provide users. Sending a check or cash through the mail can be risky as mail fraud is a real concern. Also, while there are many digital transfer options available for download on your app store, your local bank can provide a higher level of security.

We ensure all our web-based banking services meet or exceed industry security guidelines. Our mobile PIN pad is encrypted so it never travels across payment channels. Entering your PIN with your mouse or by touch ensures your account is protected even if your computer is infected with viruses or malware.

Customers should still be very vigilant when initiating a P2P transfer. Although security measures are in place, you should always double check to ensure the recipient’s information you are entering is correct.

Kelsey Dean, Marketing Specialist at F&M Bank, states, “Treat P2P just like a cash transfer. Would you give $50 to someone you really didn’t know on a personal level? It’s important to only send P2P payments to family or friends that you trust. Also, double check the amount you are sending. It’s easy to mistype or accidentally add an extra number on a phone screen.”

Ready to Get Started?

If you’re interested in using our P2P platform, visit our website or login to your F&M Bank Mobile Banking account. If you have any questions at all regarding P2P or our digital banking suite of products, please don’t hesitate to contact us!

Did you know you can also send payments or pay bills with iPay in online banking? To use iPay you just need an F&M bank user ID and password but anyone can send funds using P2P!

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.