F&M Bank Corp. Announces Second Quarter Earnings

F & M Bank Corp. (OTCQX:FMBM), parent company of Farmers & Merchants Bank, announces its financial results for the second quarter ending June 30, 2019.

Selected highlights for the quarter include:

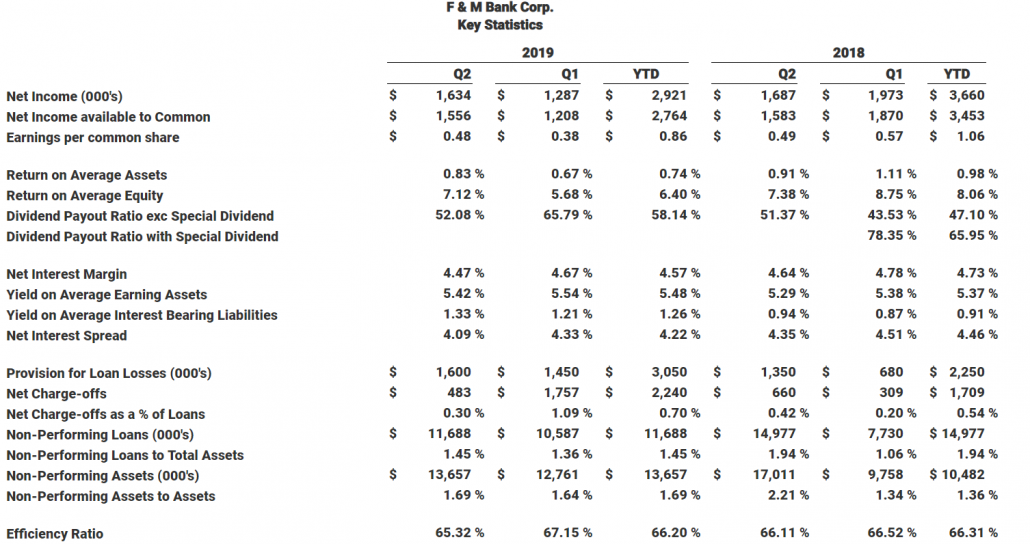

- Net income of $1.63 million;

- Net interest margin of 4.47% for the quarter and 4.57% YTD;

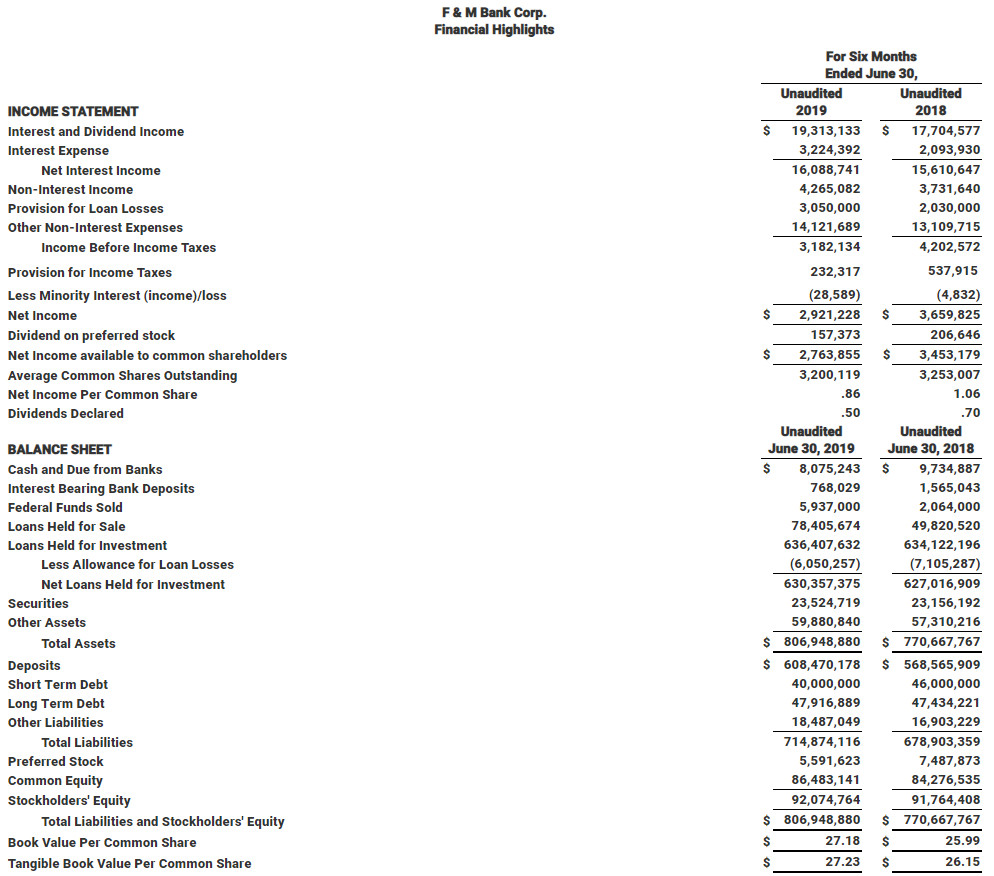

- Net interest income increased $208,000;

- Non-Interest Income increased $477,000 or 23.9% compared to the second quarter 2018;

- Total deposits increased $7.6 million and $39.9 million, respectively for the quarter and for the trailing 12 months.

Mark Hanna, President, commented “Our second quarter earnings of $1.63 million is comparable to the same period last year and an increase of $347,000 versus the first quarter. We continue to enjoy strong pre-tax core operating earnings which increased in 2019 to $3.44 million versus $3.21 million in Q2 2018. Core operating earnings continue to be fueled by a strong net interest margin of 4.47%. The margin did decrease versus the first quarter due to a combination of non-accrual adjustments and an increase in short-term mortgage loans held for sale that offer lower yields than our longer-term loan portfolio. We are also particularly pleased with our increase in non-interest income, which reflects stronger results for both our mortgage and title company subsidiaries.”

Mr. Hanna continued, “Non-performing assets have increased $.9 million versus the first quarter 2019 but have decreased $3.1 million compared to second quarter 2018. During the second quarter we charged $1.6 million to the provision for loan losses. We continue to work through several long-term problem assets and the additional provisioning positions us to move these assets off our balance sheet later this year. The additional provision also captures revisions to our loan loss methodology designed to reflect risks within our loan portfolio resulting from the increase in our non-performing asset ratios in recent quarters.”

Mr. Hanna further stated, “We are excited to announce that our fourteenth branch located at 2782 Stuarts Draft Highway, Stuarts Draft, VA is slated to open later this month. As previously announced our board approved an increase in our quarterly dividend from $.25 to $.26. This dividend is payable on August 16th to shareholders of record as of August 2nd.”

Highlights of our financial performance are included below.

F & M Bank Corp. is an independent, locally-owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank’s thirteen banking offices in Rockingham, Shenandoah, Page and Augusta Counties, Virginia. The Bank also provides additional services through a loan production office located in Penn Laird, VA and through its subsidiaries, F&M Mortgage and VSTitle, both of which are located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-8941.

This press release may contain “forward-looking statements” as defined by federal securities laws, which may involve significant risks and uncertainties. These statements address issues that involve risks, uncertainties, estimates and assumptions made by management, and actual results could differ materially from the results contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in interest rates, general economic conditions, legislative and regulatory policies, and a variety of other matters. Other risk factors are detailed from time to time in our Securities and Exchange Commission filings. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

- The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are nontaxable (i.e. municipal securities and loan income) then subtracting interest expense. The tax rate utilized is 21%. The Company’s net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns nontaxable interest income from municipal loans and securities, net interest income for the ratio is calculated on a tax equivalent basis as described above.

- The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. The efficiency ratio is a common measure used by the financial service industry to determine operating efficiency. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investments portfolio and Other Real Estate Owned. The Company calculates this ratio in order to evaluate how efficiently it utilizes its operating structure to create income. An increase in the ratio from period to period indicates the Company is losing a greater percentage of its income to expenses.

CONTACT: Neil Hayslett, EVP/Chief Operating Officer

540-896-8941

NHayslett@FMBankVA.com