F&M Bank Corp. Announces Third Quarter Earnings

F & M Bank Corp. (OTCQX:FMBM), parent company of Farmers & Merchants Bank, announces its financial results for the third quarter ending September 30, 2019.

Selected highlights for the quarter include:

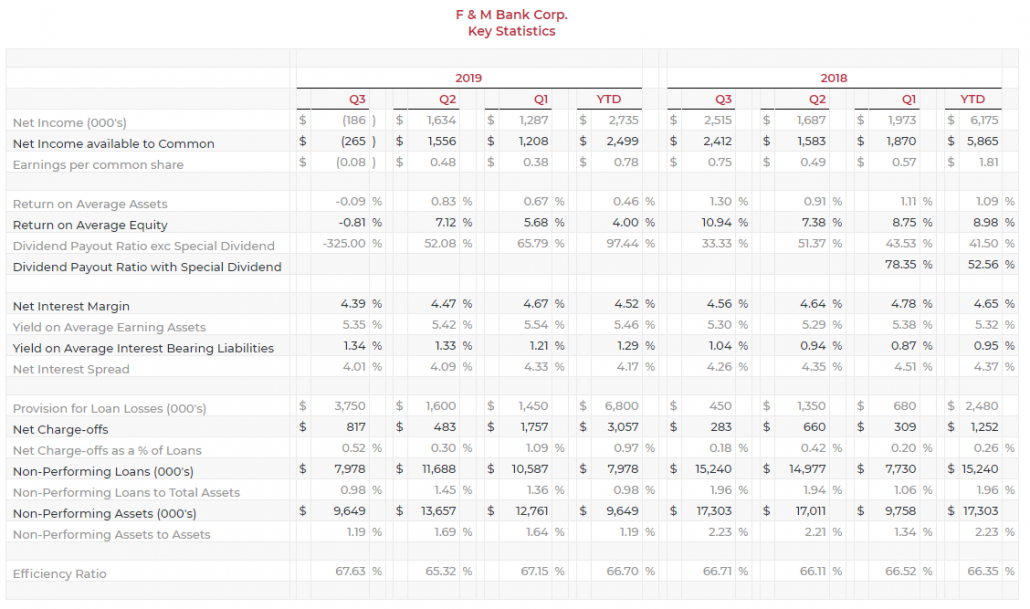

- Net loss of $186,000 due mainly to a $3.3 million increase in the Provision for Loan Losses over the third quarter of 2018;

- Net interest margin of 4.39% for the quarter and 4.52% YTD;

- Non-Interest Income increased $497,000 or 23.1% compared to the third quarter of 2018;

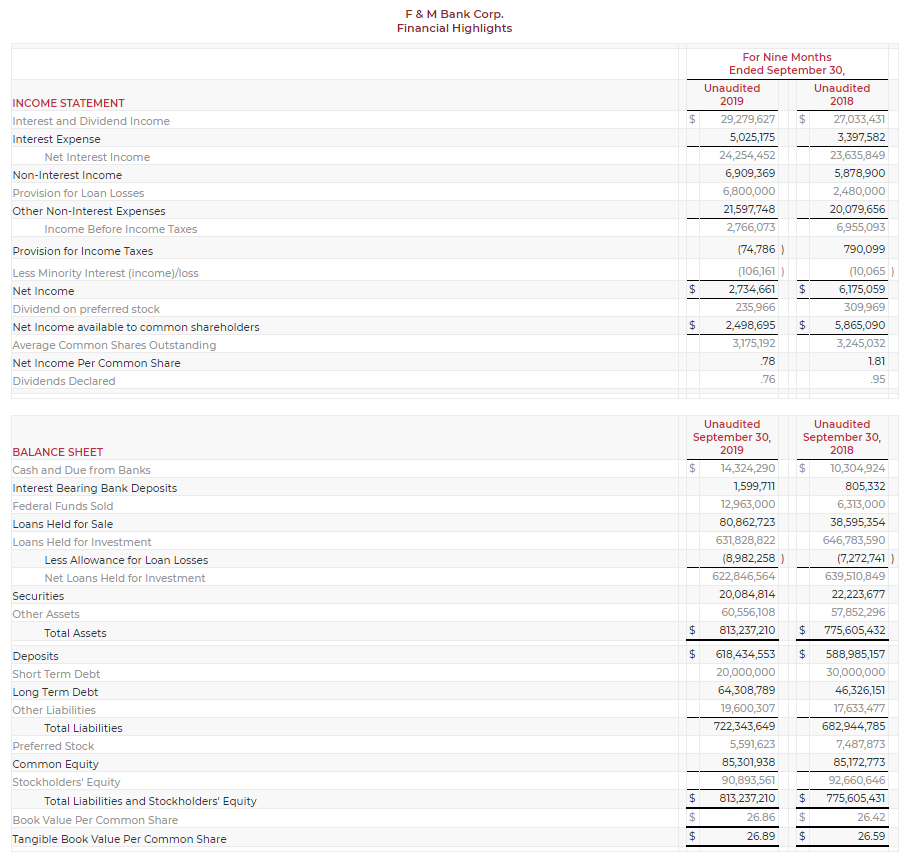

- Total deposits increased $11.7 million and $30.5 million, respectively for the quarter and for the trailing 12 months;

- Non-Interest Bearing deposits increased $7.8 million for the quarter and $15.1 million YTD.

Mark Hanna, President, commented “The Bank recognized a small net loss of $186,000 in the third quarter due mainly to increased provisions for loan losses resulting from higher levels of substandard loans. During the quarter, the Bank conducted an external loan review to identify and proactively address problem loans. As a result of these findings and the ongoing servicing of our loan portfolio, F&M Bank recorded a loan loss provision of $3.75 million. This provision represents a significant increase of $2.15 million over Q2 2019 and $3.3 million over Q3 2018. While the additional provisions to our Allowance for Loan Losses are burdensome, we feel that they fairly represent the current risk in our loan portfolio.”

“Despite these headwinds, pre-tax, pre-provision Income showed some positive momentum growing about 0.8% for the first nine months of 2019 over the same period in 2018. Core operating earnings continue to be fueled by a strong net interest margin of 4.39%. The margin has been negatively impacted by non-accrual adjustments and increases in the levels of short-term mortgage loans held for sale that offer lower yields than our longer-term portfolio. Non-Interest Income showed impressive growth of 17.5% during the first nine months of the year which reflects stronger results for both our mortgage and title company subsidiaries.”

Mr. Hanna continued, “We are perhaps most pleased with the growth in total deposits in general and non-interest bearing deposit balances in particular. As we work to change the composition of our deposit base, non-interest bearing deposits have increased 9.4% year to date ($15.1 million) while time deposits have declined 8.7% year to date ($13.5 million). Even with the decline in time deposits, total deposits have increased over 5% in the first nine months of 2019 which should create a stable, cost-effective funding source going forward.”

Mr. Hanna further stated, “We are excited to announce that our fourteenth branch located at 2782 Stuarts Draft Highway, Stuarts Draft, VA opened in September. As previously announced our board approved a quarterly dividend of $.26. This dividend is payable on November 15, 2019 to shareholders of record as of November 1, 2019”.

Highlights of our financial performance are included below.

F & M Bank Corp. is an independent, locally-owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank’s fourteen banking offices in Rockingham, Shenandoah, Page and Augusta Counties, Virginia. The Bank also provides additional services through a loan production office located in Penn Laird, VA and through its subsidiaries, F&M Mortgage and VSTitle, both of which are located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-8941.

This press release may contain “forward-looking statements” as defined by federal securities laws, which may involve significant risks and uncertainties. These statements address issues that involve risks, uncertainties, estimates and assumptions made by management, and actual results could differ materially from the results contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in interest rates, general economic conditions, legislative and regulatory policies, and a variety of other matters. Other risk factors are detailed from time to time in our Securities and Exchange Commission filings. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

- The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are nontaxable (i.e. municipal securities and loan income) then subtracting interest expense. The tax rate utilized is 21%. The Company’s net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns nontaxable interest income from municipal loans and securities, net interest income for the ratio is calculated on a tax equivalent basis as described above.

- The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. The efficiency ratio is a common measure used by the financial service industry to determine operating efficiency. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investments portfolio and Other Real Estate Owned. The Company calculates this ratio in order to evaluate how efficiently it utilizes its operating structure to create income. An increase in the ratio from period to period indicates the Company is losing a greater percentage of its income to expenses.

CONTACT:

Carrie A. Comer EVP/Chief Financial Officer

540-896-8941 or ccomer@fmbankva.com

SOURCE: F & M Bank Corp.

View source version on accesswire.com:

https://www.accesswire.com/564541/F-M-Bank-Corp-Announces-Third-Quarter-Earnings