Best Apps for Money Management

With the proper tools, it’s never been easier to build your financial literacy, monitor daily transactions, and grow your accounts to meet short and long-term savings goals.

Do you like to use technology to problem solve and create more efficiency in your life? If you said yes, then “fintech,” a term that describes the merging of tech and finance, is a good match for you. With an ever-growing number of money management apps, access to everything from personal accounts to global markets is at our fingertips. People of all ages from kids to retirees, as well as business owners, can not only get a detailed overview of their financial situation but have fun tracking every dollar and cent. With the proper tools, it’s never been easier to build your financial literacy, monitor daily transactions, and grow your accounts to meet short and long-term savings goals.

Whether it’s creating a budget, organizing your personal finances, saving for vacations and retirement, or managing your small business’ spending, all aspects of your money can be managed directly from your smartphone. We’ve identified some of the best personal finance, investment, business, and kids’ apps to streamline your time and resources. All are free to download and use unless otherwise noted.

Best Personal Finance Apps

From credit cards to bank and retirement accounts, our financial lives are complicated. Understanding what you have and how to make it work for you is critical. Whether you’re trying to improve your credit score before making your first home purchase, or you want to save for a vacation or big purchase, these apps can help you take those specific steps as well as basic ones like creating a budget.

Know Your Credit Score

As your credit score is the backbone of your financial life, consider downloading Credit Karma. It gives you a free copy of your credit report as well as advice on steps you can take to get your score where you want it to be. In this age of online security threats, Credit Karma also provides you with notifications to alert you to new activity reflected on your report.

Banking Apps

Your bank account is at the heart of all you do, from paying bills to buying lunch on the go. A sound banking app, such as F&M Bank’s Mobile Banking app will make you the master of your domain from the convenience of your phone or tablet. Your account is kept safe via passcode or touch ID entry to the app, where you can view transactions, pay bills, deposit checks through mobile deposit, and transfer funds between F&M bank accounts. Using the F&M mobile app will not save any sensitive information to your phone.

Best Apps for Business Owners

Companies with a business checking account can also use their bank’s mobile app to keep track of daily transactions and cash flow.

Beyond you’re a business banking app, inDinero is a tax compliance and accounting app that compiles information from all of your business bank accounts and credit cards to present a clear, comprehensive view of your company’s spending. Discover where your money goes and when, and obtain forecasts of future spending based on current trends. inDinero allows you to gain insight into the total picture of your business’ finances. Plans start at $295/month.

To take the pain out of small business accounting, consider adding Freshbooks to your life. This software makes your billing process seamless and straightforward, creating attractive, professional invoices in seconds. You can track your time on projects and follow-up with clients directly from Freshbooks, freeing you from cumbersome paperwork and administrative tasks. Freshbooks allows you to track your expenses and, because it’s cloud-based, you can have a snapshot of all of your business expenses anytime, anywhere. After a 30 day free trial, Freshbooks offers monthly plans starting at $10.

Best Money Apps for Kids

Best Money Apps for Kids

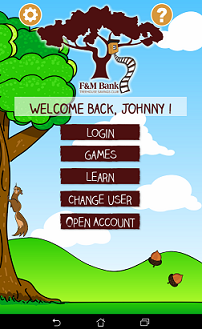

F&M Bank Treehouse Club makes saving fun. Kids can access their savings account as well as play games designed to increase their financial literacy. The app makes earning and learning can be exciting for little ones.

PiggyBot is a virtual piggy bank to make savings a more hands-on experience for kids. They can feature photos of the items they are saving for in PiggyBot for additional incentive to keep adding to their bank, combining the popularity of picture-based platforms into the app.

How will you use “Fintech” to manage your money?

Whatever your current financial situation and future goals, the range of quality personal finance and business apps can make the path to a sound financial future easier and more manageable than ever. With just a few apps added to your tablet or mobile device, you can understand your money in new ways and, more importantly, make it work for you. F&M Bank customers, and those who would like to open an F&M Bank account, can take advantage of our free Personal Financial Management Tool, Squirrel. It’s just another way we fulfill our mission as a community bank to meet the needs of our customers and community by offering the best financial products.

ChannelImages

YToxOntzOjE3OiJ0cmlnZ2VyX3JldmlzaW9ucyI7czoxOiIxIjt9