F&M Bank’s Chief Experience Officer, Charles Driest, talks about striking the right balance between digital innovation and a personal customer approach

Charles Driest is the newly-appointed Chief Experience Officer at Farmers & Merchants (F&M) Bank. A graduate of George Mason University in Virginia, and later St. John’s University in New York, he began his banking career shortly after returning to Virginia from New York in 2007.

Before this, Driest’s early career saw him employed by the Grocery Manufacturers Association (MGA), and, later, at the American think-tank, Brookings Institution. It was here he was struck with inspiration to retrain in finance by a former manager, Roberta Cohen.

Driest says: “She said if I didn’t go back to school she would fire me. This was probably my biggest inspiration. It amazes me that her voice is always in the back of my head, and when she told me that, it was about two decades ago.”

F&M Banks’s new Chief Experience Officer hasn’t exactly been short of inspiration, either: “I’ve been really lucky because I’ve had a lot of influencers in my career, with bosses and managers who have pushed me to take on new risks that perhaps I didn’t feel I was ready for, but gave me a great opportunity to learn.”

Beginning his banking career after reeducating in New York and returning to Virginia, Driest was again inspired to follow a digital path in his career. “One of the first CEOs I worked for taught me a valuable lesson; it’s how I got into the digital side of the banking business.

“At the time we didn’t have a good grasp of our digital spending at the organisation. My CEO asked me to break down the numbers to explain to executive management where the money was going. So I sifted through 12 months of invoices and began asking operational questions: where’s our money going? How do we better manage this?

“This is when I found out the business had these operational holes, while we didn’t have the right insights into the capabilities available to us that we were using. So my CEO said: ‘You found the problems, go fix them’. This is what got me into digital banking, furthering my career by putting me into a situation I wouldn’t necessarily have been comfortable in initially.”

This valuable experience in digital banking saw Driest become F&M Bank’s Director of Digital Banking sometime after, a role he had for “14 to 15 months” before being promoted to F&M Bank’s Chief Experience Officer.

Despite his brief time in the role so far, Driest says: “Taking on three new reports has been a lot of fun. I really enjoy the personnel management aspect of things. I like watching the development of people. From my perspective, I really like to see the process of a team getting onto one page, because it has a powerful multiplying effect. The pace of work speeds up when everybody is in sync.”

Achieving synchronisation for the now is key to driving growth in the future, according to Driest, who has deep excitement for the future of banking as the proliferation of fintechs continues, believing community banking will endure despite the growth of technology.

He concludes: “I’ve seen some of the biggest developments in banking over the years, and I feel even with all the fintechs out there, I think ultimately, community banking will survive. If there’s one thing banks are very good with, it’s about integrating technology that is focused on the customer.

“For anyone that talks about the speed of fintech growth, fundamentally, it still relies on people, and people don’t change habits that quickly. The arc of change and the pace of change will always be constrained by people at the end of the day. So, as long as you’re making good decisions and always looking ahead by two to three years at a time – it doesn’t matter what type of bank you are – you’ll probably end up in a good place.”

F&M Bank has been featured in the July issue of FinTech Magazine

In this exclusive interview, Charles Driest, Chief Experience Officer, discussed striking the right balance between digital innovation and a personal customer approach.

“The future is technology and people, that’s what is going to win the day – not one or the other”

BizClik’s FinTech portfolio connects banking, financial services, payments, technology & consulting brands and their most senior executives with the latest FinTech trends, industry insight, and influential FinTech, InsurTech & Crypto projects as the world embraces CX, Business Transformation and Digital Ecosystems. FinTech Magazine and its entire portfolio is now an established and trusted voice on all things FinTech, engaging with a highly targeted audience of 113,000 global executives. We provide key industry players with the perfect platform to showcase their brands, develop content syndication plans, webinars, white papers, demand generation as well as a global set of events (In-Person & Virtual).

BizClik is a UK-based media company with a global portfolio of leading industry, business and lifestyle digital communities.

BizClik’s portfolio includes Technology & AI, Finance & Insurance, Manufacturing & Supply Chain, Energy & Mining, Construction, Healthcare, Mobile & Data Centres and EV. For further information, please visit https://www.bizclikmedia.com/

You can read the report in the latest issue of FinTech Magazine by clicking HERE

About F&M Bank

F&M Bank Corp. (OTCQX: FMBM) proudly remains the only publicly traded organization based in Rockingham County, VA, and since 1908, has served the Shenandoah Valley through its banking subsidiary F&M Bank, with full-service branches and a wide variety of financial services, including home loans through F&M Mortgage, and real estate settlement services and title insurance through VSTitle. Both individuals and businesses find the organization’s local decision-making and up-to-date technology provide the kind of responsive, knowledgeable, and reliable service that only a progressive community bank can. F&M Bank has grown to $1 billion in assets with more than 175 full- and part-time employees. Its conservative approach to finances, sound investments, and excellent customer service have made F&M Bank profitable and continues to pave the way for a bright future.

###

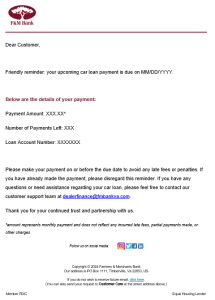

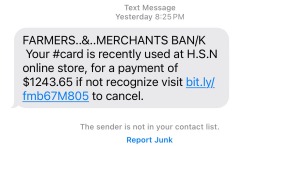

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.