Stuarts Draft Now Open

F&M Bank is excited to announce the opening of our 14th branch in Stuarts Draft! Over the next four weeks, we have big things planned. Be sure to keep reading to meet our staff, learn about our giveaways and save the date for our Ribbon Cutting and Grand Opening celebration!

Location

2782 Stuarts Draft Highway, Stuarts Draft, VA 24477

(540) 609-2363

You can find us conveniently located between the Stuarts Draft Professional Center and the Dollar General, up the street from the Stuarts Draft Post Office. When you visit F&M Stuarts Draft you’ll find a new brick building with limestone pavers. We have plenty of parking available in front of our branch building, as well as a wheelchair-accessible entrance.

Jason Crum, Branch Manager

Join us in welcoming Jason! Coming to F&M Bank with six years of banking experience, Jason Crum is ready to lead the Stuarts Draft team. He’s already been out and about in Stuarts Draft, but if you haven’t had a chance to connect with him, drop by our branch!

Much like his team, Jason is community centered. He is an assistant coach for a local youth sports organization and an active volunteer with United Way, Salvation Army and Adopt-a-Highway.

When asked about choosing banking as a career, Jason said, “What I enjoy most about working in banking is being able to help people and make a difference in their lives. Bank clients become family, and there is nothing more satisfying than helping someone gain financial confidence.”

Outside the office, Jason loves to spend time with his wife, Tayler, and 10-month-old son, Mackson. He also enjoys playing golf, spending time with friends, watching sports, attending ODU football games, and interestingly, mowing the grass!

Kacee Fridley, Branch Specialist

Say hello to Kacee! After spending 4 years serving the Craigsville community, Kacee Fridley is excited to make the transition to the Stuarts Draft branch. In total, she brings 7 years of banking experience to the new office.

Kacee is an active community member. Along with Jordan, she has a soft spot for animals and does what she can to help various animal rescues. She also likes to attend community meetings and help raise awareness and donations for area organizations, specifically Foster Love Ministries.

When asked what she loves most about banking, Kacee said, “I enjoy being able to firsthand help all of my customers whether it’s a simple bank transaction to accounts and loans as well! I take pride in being able to open someone’s first account, help them purchase their first vehicle and later with a mortgage!”

Outside the office, Kacee enjoys spending time with her husband, Michael, and two children. Plus, we can’t forget about her two dogs, who are a large part of her family.

Jordan Smitherman, Branch Specialist

Meet Jordan! Transitioning to Stuarts Draft from our Myers Corner (Staunton) office, Jordan Smitherman brings four years of banking experience to the new branch!

Jordan is involved in her community and enjoys volunteering at local animal shelters and working with rescues to help find foster homes and permanent placement for homeless animals. She also likes regularly volunteering at community events through the bank!

When asked what she loves most about being a banker, Jordan said, “I am able to support people with their financial needs in all stages of their lives. I love being able to witness children open up their first savings account to a newlywed couple being approved for financing on their first home.”

In her free time, you’ll find Jordan spending time with her husband, Zac, and their fur babies. They enjoy working on home improvement projects together.

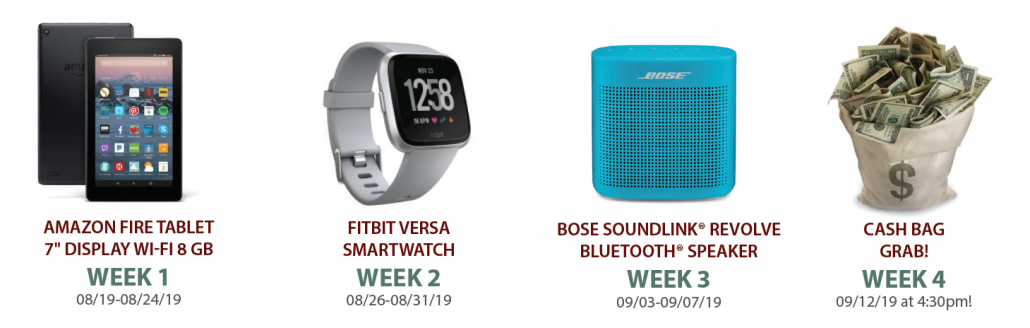

Weeks of Giveaways

Our responsive and knowledgeable staff is ready to listen to your financial needs and goals and help you identify the right solutions. Come check us out in Stuarts Draft and discover all that F&M has to offer!

As an extra incentive, over the first four weeks of branch opening, you can enter to win various door prize giveaways! Stop by each week and enter to win the below prizes. Limit one entry per person, per week.

We’d also like to cordially invite you to attend our Ribbon Cutting and Grand Opening Celebration on Thursday, September 12th at 4:30pm! Co-hosted by the Greater Augusta Regional Chamber of Commerce, our event will feature catering by Simple Elegance, local wines, the cash bag grab, and more!

To learn more about the event and our four weeks of giveaways, follow us on Facebook!