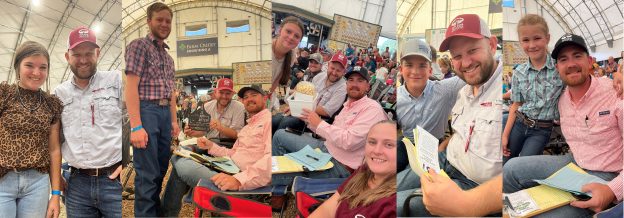

Introducing Olivia Wightman: Ag Lender and Relationship Manager

We’re excited to introduce Olivia Wightman, the newest member of our Ag team! Olivia interned with our Ag department in 2023, and it was clear she would be an amazing candidate to add to team F&M. Since joining our team, she’s already rolled up her sleeves to represent F&M Bank at the Farmers Livestock Exchange in Winchester, showcasing our strong connection to the agricultural community and our unique services.

My name is Olivia Wightman, and I am from Edinburg, Virginia. In my family, I have my dad, Bryon, my mom, Karen, and my brother, Gus. Agriculture has always been a passion of mine; this sparked during my time in high school when I joined FFA and served as an officer. This experience encouraged me to pursue a career in agriculture. At college, I majored in Agribusiness Management with a minor in Professional Sales. I was actively involved in campus life, joining Alpha Delta Pi and I was a sweetheart for Alpha Gamma Rho. Additionally, I was the president of the National Agri-Marketing Association during my senior year. This spring, I graduated Magna Cum Laude from Virginia Tech. Last summer, I interned at F&M Bank, spending five weeks in the agriculture department and another five weeks in the credit department. I knew that becoming an ag lender was something that interested me, so I decided to make a career out of it!

To help you get to know Olivia a bit better, we decided a round of 21 Questions (it’s really only 12) was in order.

Why F&M? What made you want to join our team?

I interned in the summer of 2023, and I really enjoyed it. Agriculture has always been a passion of mine and to be able to help the agriculture community and to be a helpful resource is super important to me. Additionally, I knew that F&M was a fit because of the culture and how welcoming F&M was to me!

What behavior or personality trait do you most attribute to your work ethic, and why?

I would say being optimistic and having a determined attitude contribute a lot to my work ethic.

The four core values that F&M holds dear are Gregarious, Resolute, Original, and Wholehearted. Which of these values resonates with you the most? Why?

I would say “wholehearted” resonates with me the most because I consider myself a person who goes the extra mile to make someone happy, and I care about relationships with others.

How do you start your day? What gets you going?

I start my day with a cup of coffee and listening to music. (country specifically)

What is your hidden talent?

If I told you, it wouldn’t be a secret.

What’s an accomplishment that you’re really proud of?

Graduating Magna Cum Laude from Virginia Tech and making the dean’s list all eight semesters.

What’s one thing you’re currently trying to make a habit?

Going to the gym after work.

What’s your guilty pleasure?

Eating popcorn and watching literally anything on Netflix.

What’s the top destination on your must-visit list?

Greece.

If you could choose a superpower, what would it be?

My superpower would be to read minds!

What is the best piece of advice anyone has ever given you?

Even when you do not believe in yourself, it is important to keep going. You might not think you’re good at something, but with practice and determination, you might surprise yourself.

List three items on your bucket list

Go outside the country.

Go to Pig Island.

Learn how to snowboard.

If you could quickly and easily learn any new skill, what would it be?

Juggling.

To learn more about our ag products or about our ag team, contact agribusiness@fmbankva.com or Olivia directly!

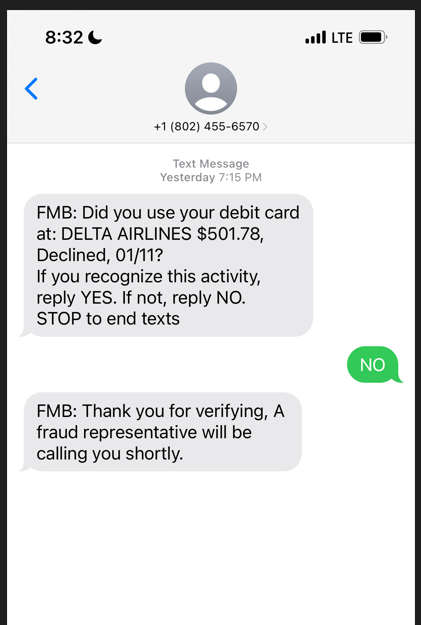

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.