First Time Home Buyers Guide For Virginia

Homeownership is woven into the fabric of the American dream, but the process can seem daunting to first-time homebuyers. As your community bank and mortgage lender, F&M Bank and F&M Mortgage are here to help. In this comprehensive guide we break down everything you need to know about buying your first home in Virginia, from costs to mortgage loan options and the major steps in the process. If you have questions as you read, feel free to reach out to our friendly and experienced team of mortgage lenders. We’re here to help!

How Much Does It Cost To Buy and Own a Home In Virginia?

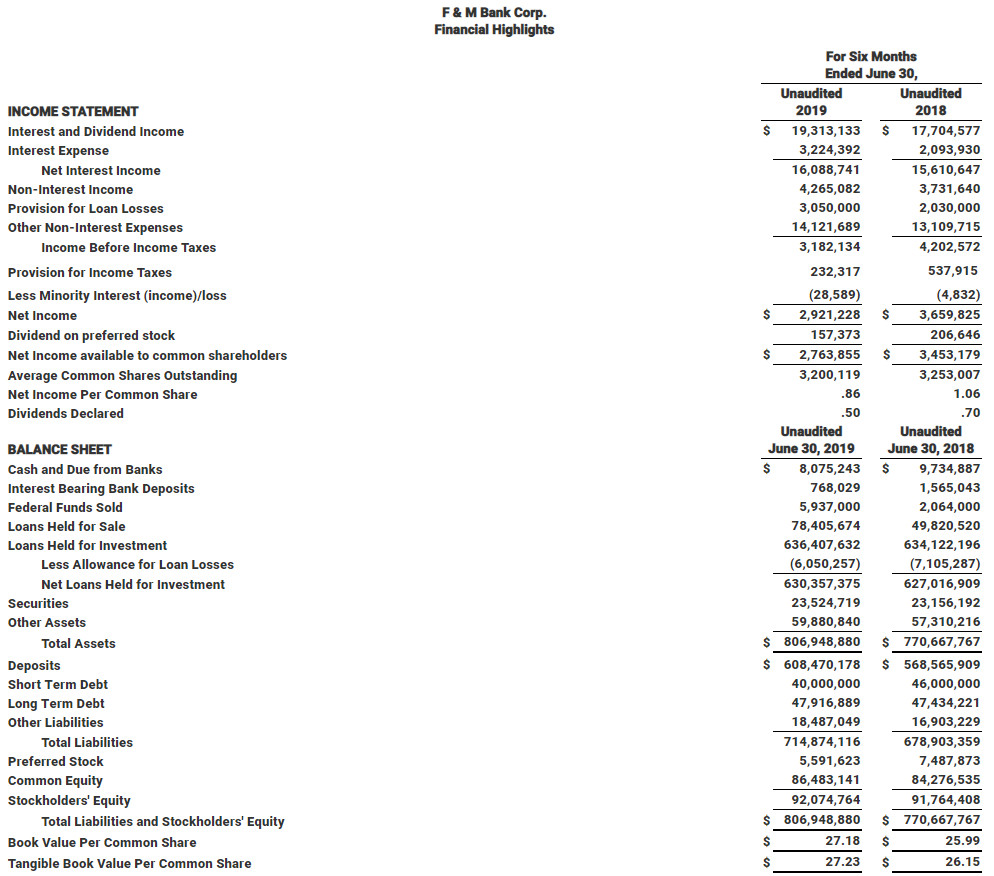

Real estate has always been a local business, and this is especially true in Virginia, where home costs vary widely depending on the region and metro area. Here in the Shenandoah Valley, the median home price for Harrisonburg is $203,700. Your down payment will depend on the type of home loan you apply for. At F&M Mortgage, we offer everything from no-down-payment mortgage loans to low-down-payment options and conventional mortgages with a 10-20 percent down payment. In general, the more you can put down, the lower your monthly payment will be. For most home loans, you’ll need to pay Private Mortgage Insurance premiums each month if you put less than 20 percent down. However, there are plenty of options for aspiring homeowners who can’t come up with a big down payment.

Closing costs are the second expense associated with buying a home. These vary as well, but in general, you can expect to pay between $4,000-$9,000. Your lender will share a breakdown of closing costs with you beforehand so you know how much you need. If you have concerns about coming up with both a down payment and closing costs, don’t worry. We’ll cover closing cost assistance programs below.

Once you’ve bought your home, your biggest expense will be your monthly mortgage payment, which encompasses the loan payment of principal and interest, as well as your property tax and home insurance premium. To continue with our Harrisonburg example, the real estate tax rate is .86 cents per hundred of assessed value. This works out to fairly low property taxes; for example, if you need to pay $1,253 in annual real estate taxes, this is only about an extra $100 each month added to your mortgage payment. Remember that the assessed value of your home is usually less than what you bought it for. When it comes to home insurance premiums, you can expect to pay about $35 per month per $100,000 of home value.

Now that you understand the basic costs of buying and owning a home, it may be more affordable than you thought. Let’s look at federal and state programs to help first-time buyers obtain home loans and down payment or closing cost assistance.

Federal Programs for First Time Buyers

Since 1934, when the Federal Housing Administration (FHA) was created to help Americans obtain home financing in the aftermath of the Great Depression, the federal government has launched a variety of initiatives to make homeownership more accessible.

Within the context of federal home loan programs, a first-time buyer doesn’t necessarily have to be someone who has never owned a home before. We’ll cover the eligibility requirements for each program below. As you’ll see when we get to Virginia programs for first-time buyers, there are instances where federal and state home loans and home buying assistance work in tandem.

FHA Loans

This is the original federal home loan program and it is open to anyone who meets the eligibility requirements. An FHA mortgage is a great option if you’re looking for a low-down-payment home loan. Depending on your FICO credit score, you may qualify for the maximum 96.5 percent financing, meaning you’d only need to make a 3.5 percent down payment. For our $203,700 median home price, 3.5 percent would be $7,130. That’s much easier to save for than a full 20 percent down payment of $40,000.

Benefits of an FHA Mortgage Loan

- Flexible credit approval

- Low down payment

- Low closing costs

- Available for 1-4 unit properties

- Can be used for manufactured and modular homes

FHA Loans and Mortgage Insurance

FHA loans are great for homebuyers who can’t afford a larger down payment or whose credit score might disqualify them from obtaining a conventional loan. In return for this flexibility, FHA borrowers pay an upfront mortgage insurance premium of 1.75 percent of the loan amount. You’ll also pay an annual mortgage insurance premium of 0.45 percent to 1.05 percent, divided by 12 and paid each month as part of your mortgage payment. The FHA mortgage insurance premium is for the life of your loan unless you refinance into a conventional mortgage.

VA Loans

Established in 1944 with the GI Bill of Rights, VA loans are available to current service members, veterans, and certain surviving spouses. The VA home loan program is very generous, with up to 100 percent financing, no mortgage insurance premiums, and low closing costs. The only added cost is a VA fee of 1.25 percent to 2.4 percent of the home’s value.

Benefits of a VA Mortgage Loan

- Low or no down payment

- No mortgage insurance requirement

- Low closing costs

To learn more about VA loans, check out our comprehensive guide.

USDA Loans

USDA mortgages fall under the US Department of Agriculture and are intended to encourage home purchases in rural and semi-rural areas. Depending on your credit score, you may not have to make a down payment on a USDA loan. USDA loan eligibility is also based on your household income, which can’t be more than 115 percent of the median income in your county. USDA borrowers must also first try and fail to obtain a conventional mortgage.

Benefits of a USDA Loan

- No or low down payment

- Flexible credit approval

- Some suburban areas count as “semi-rural”

HUD’s Good Neighbor Next Door Program

If you are a law enforcement officer, primary school teacher, firefighter, or EMT, you may be eligible to purchase a single-family home in a designated revitalization area at a 50 percent discount off the list price. As long as you live in the property for at least three years, you won’t have to pay back the 50 percent discount. You can also sell the house for its full market value and keep the profit. Search for current listings here.

Fannie Mae HomeReady

Designed for creditworthy low-income borrowers, the HomeReady mortgage permits down payments as low as 3 percent. Also, your down payment and closing cost money can come from a variety of sources, including grants. There is no minimum requirement for personal funds. And while you’ll need to pay for Private Mortgage Insurance (PMI), you can cancel it once you have at least 20 percent equity in the home.

Freddie Mac Home Possible Loan

Like the HomeReady mortgage, the Freddie Mac Home Possible Loan offers a down payment as low as 3 percent. You also have flexibility with the sources of your down payment and closing cost funds. Home Possible borrowers can even have a co-borrower on the loan who doesn’t live in the same residence. Overall, the Home Possible mortgage is great for self-employed individuals as well as those working in the gig economy.

Virginia-Specific Programs for First Time Home Buyers

The Virginia Housing Development Authority (VHDA) offers 30-year fixed-rate mortgages, forgivable down payment grants, and federal tax breaks to first-time homebuyers in the state. In this case, the first-time buyer simply means that you haven’t owned part or all of another house in the past three years.

VHDA loans come with income and purchase price limits that are set by county. To qualify, you need a minimum 620 credit score, must be willing to make the house your primary residence and have to finish a homeownership education course first.

VHDA Fannie Mae HFA Preferred No MI

This mortgage loan offers a low down payment of 3 percent and there is no mortgage insurance requirement. You can also use a VHDA Down Payment Assistance grant and Mortgage Credit Certificate to reduce the cash you need to pay upfront.

“The VHDA has struck a special deal with Fannie Mae with this program, which is designed for first-time and repeat homebuyers with a credit score of at least 640. Down payment requirements start at just 3 percent. The affordable monthly payment and discounted upfront cost is great, but it’s the insurance benefit that really shines.”

VHDA FHA Plus Loan

If you’re interested in a standard FHA loan, but don’t have enough cash for the down payment, the VHDA FHA Plus Loan might be the best option for you. Obtain up to 100 percent financing with a second mortgage that covers your upfront closing costs and down payment. County income limits apply and the combined loan total cannot exceed VHDA’s home price limits.

VHDA Rural Housing Services (RHS)

This is the VHDA’s version of a USDA mortgage. If you wish to buy a single-family house in a qualified area, you can take advantage of 100 percent financing, low mortgage insurance premiums, and a discount on your federal tax bill.

VHDA Down Payment Assistance Grant

This grant can be used in combination with a variety of mortgage loans. Get up to 2.5 percent of your home’s value to put toward your down payment. Qualified home buyers don’t have to repay the down payment assistance grant.

VHDA Mortgage Credit Certificate

If you qualify for the VHDA’s down payment assistance grant, you can also file for the Mortgage Credit Certificate, which lets you claim 20 percent of your annual mortgage interest as a federal tax credit for the life of the loan.

From Pre-Qualification to Closing: Understanding the Homebuying Process

One of the most important decisions you’ll make at the beginning of this process is finding the best lender. You want to look for local expertise, a long history of mortgage lending, and friendly service. This will help ensure a smooth and timely mortgage and home buying process. As a local lender serving the Shenandoah Valley, F&M Mortgage has been helping first-time buyers become homeowners since 1999. We offer a complete suite of conventional, VHDA, VA, USDA, FHA, and zero-down-payment Spark Loans.

- Get pre-qualified for a home loan. Pre-qualification letters carry more weight with sellers than pre-approvals. They demonstrate the seriousness of your intentions and vouch for your ability to get a mortgage.

- Find a buyer’s agent to help in your home search. As with mortgage lenders, we recommend looking for someone with experience in the local real estate market and a specialization in working with buyers.

- Fall in love with a house and make an offer. Once your offer is accepted, you will be “under contract” with the seller. Your mortgage lender will appraise the house and work through the underwriting process. You may be asked to provide additional documentation during this stage.

- Get a home inspection. While this isn’t a requirement, it’s highly recommended. Paying for a home inspection will give you a complete and thorough report on the condition of just about everything in your house. If repairs are needed, you can renegotiate the purchase price with the seller.

- Go to closing. The entire process can take anywhere from 4-6 weeks between the contract and the closing. Once the big day arrives, you can expect to sign a lot of paperwork and walk away with the keys to your new home. Congratulations!

Learn more about buying a home in the Shenandoah Valley!

Meet our experienced team of mortgage lenders and give us a call at 540-442-8583 to get answers to all of your home buying questions. Ready to apply for a mortgage loan? You can apply online or in any of our branch locations. Looking for more information about the Shenandoah Valley region of Virginia? Check out our relocation guides for Staunton and Augusta County and Harrisonburg and Rockingham County.

F&M Bank is pleased to announce the promotion of Mary Pavlovskaya to Business Deposit Services Officer. Since 2011, Mary has served in a variety of roles at F&M Bank: retail, back office, and compliance. Her well-rounded experience in the banking industry is an asset as she transitions to a commercial role.

F&M Bank is pleased to announce the promotion of Mary Pavlovskaya to Business Deposit Services Officer. Since 2011, Mary has served in a variety of roles at F&M Bank: retail, back office, and compliance. Her well-rounded experience in the banking industry is an asset as she transitions to a commercial role. F&M Bank is happy to welcome Matt Hill as Commercial Relationship Manager to the Augusta County Business Development team. Matt brings with him over 13 years of lending and credit experience including consumer, mortgage, agriculture and commercial.

F&M Bank is happy to welcome Matt Hill as Commercial Relationship Manager to the Augusta County Business Development team. Matt brings with him over 13 years of lending and credit experience including consumer, mortgage, agriculture and commercial.