Identity Theft Protection Guide

How safe is your financial and personal data? Identity fraud has been growing for the last few years. In 2017, there were a record 16.7 million victims of identity fraud and a total of $16.8 billion stolen in the U.S. alone. And while identifying information can be stolen from offline sources like unshredded mail, online activities like shopping now pose the biggest threat. You may think you’re already familiar with cybersecurity best practices. However, cybercriminals continue to evolve their methods into increasingly sophisticated ploys to steal your identity and your money. Everyone⸺from government, corporations, and financial institutions to individuals⸺has a role to play in preventing identity theft and fraud. In this guide, you’ll find the latest tips for protecting your sensitive information and your bank account. Keep reading to discover how many you know and how many are new to you. Then put them into action!

What are the different types of identity theft?

Your first line of defense in preventing identity theft is to understand the various forms it takes. Here are the current most popular types of identity thefts:

- Tax: Common during tax filing season, tax ID theft occurs when someone steals your social security number in order to falsely file federal and/or state returns under your name. The purpose of tax ID theft is to steal your tax refund before you get around to filing and collecting it yourself.

- Medical: This is when someone steals your Medicaid, Medicare, or private health insurance ID number in order to obtain medical services under your name or send fraudulent bills to an insurer to collect the reimbursements.

- Social Media: Cybercriminals will even steal your name and photo to use in a fake social media account. For example, Retired Army Colonel Bryan Denny had his photo stolen and used on a variety of websites, from social media platforms to online dating sites. Cybercriminals will fake romantic relationships in order to steal money from unsuspecting women. They may also use fake profiles to inflate follower numbers or to spread disinformation.

- Financial Identity: This encompasses any fraudulent use of your financial accounts, such as using your stolen debit or credit card, and online shopping fraud where the cyber criminal uses your account to make a purchase and then has it shipped to a different address.

- Child Identity: This type of ID theft isn’t as common as the others, but it still affects about a quarter of children under 18. Thieves can steal a child’s social security number and other identifying information to open credit accounts and other fraudulent activity.

Now that you can recognize the most common identity theft scams, it’s time to brush up on your prevention skills.

13 Tips For Foolproof Identity Protection

We start with general tips and move to specific advice for protecting yourself online and on mobile devices.

- Don’t share your personal information with anyone. Reputable businesses and banks will never ask for your social security number, account number, pin, password, or any other sensitive data. So, whether you get a phone call or an email posing as a legitimate business you have an account with, never share any information that could be used to log into your bank or bill accounts, or to open a credit account in your name.

- Look over your shoulder. The simplest way to steal information is to observe someone’s computer or mobile device screen. Stay alert to your surroundings, especially when you’re in a public space and entering personal information.

- Shred physical mail and confidential documents. Buy a personal shredder for your home or take advantage of local shredding opportunities such as F&M Bank’s 2019 Community Shred Day Events. Dispose of receipts, bank statements, credit card offers, bills, and any other papers with sensitive information. You should also shred old tax returns once you are past the date of needing to keep them. Check the IRS guidelines for how long to hold onto returns.

- Enroll in e-statement delivery and billing. One way to prevent identity theft through physical mail is to switch to electronic delivery as much as possible. Receive bank statements and monthly bills through email instead. As a bonus, you’ll also help the environment by reducing paper use!

- Set up text alerts to monitor account transactions. Most banks offer mobile banking apps with an option to set up certain text alerts. For example, F&M’s Mobile Banking allows you to establish text alerts for specific types of transactions or any transaction above a specific amount. This could help you detect and report fraud as soon as it happens.

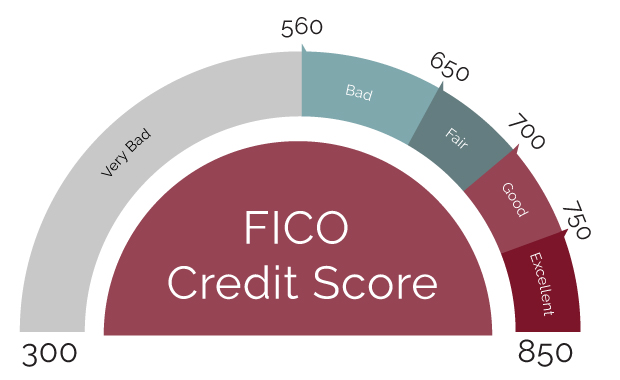

- Keep tabs on your credit report. A regular review of your credit report will let you know if any unauthorized accounts have been opened in your name. Federal law gives you the right to receive a free copy of your credit report once a year from each of the three agencies. If you space it out, you could review your report 3 times a year.

- Keep your virus protection updated. Since the majority of identity theft cases now originate online, particularly in the context of e-commerce, it’s very important to check your computer’s virus protection software for updates. Also, complete updates for other computer software such as your operating system, web browser, etc.

- Browse the web securely. Only use websites that begin with “https” instead of just “http.” The ‘s’ stands for secure. Also, look for a padlock or key icon on your browser bar when you shop online or log into an account. When using public wifi, limit your activities to non-secure web browsing. Don’t enter your credit card information or check your bank balance, for example. Cybercriminals could steal your sensitive information because the wifi network is not secured.

- Designate one card for online shopping. Instead of using multiple credit and debit cards to make online purchases and pay bills, consider using just one. That way, if your card information is stolen, you can limit your exposure. It’s also better to use a credit card if possible. You can dispute fraudulent charges and you don’t risk having your checking account emptied.

- Keep your mobile device secure. A phone or other mobile device can be a treasure trove of information for a cyber-criminal. Protect yourself by using a passcode or pattern lock; wiping all data from the phone if it is lost, stolen, or you decide to give it away; and being selective about the apps you download. Both Apple and Android offer apps for finding a missing phone and remotely deleting data if it is permanently lost or stolen. You should also keep your mobile device’s operating system software up to date⸺don’t ignore those Update Needed reminders!

- Beware of mobile phishing scams. “Phishing” simply refers to fraudulent messages from scammers posing as a legitimate organization or person. Don’t open links or attachments in texts and emails that you weren’t expecting or that come from unknown senders. Ignore pop-up messages offering to repair an infected device.

- Make your passwords hard to guess. Don’t use publicly available information, such as a birthday or child’s name. Experts recommend passwords that consist of the first letter of each word in a phrase. For example, “Life is good at the beach” would become “LIGATB.” Add numbers and symbols to replace certain letters, such as a ‘0’ instead of an ‘o’ or ‘@’ instead of ‘a,’ and to extend the length of your password. Don’t share your passwords with anyone, even family and friends. Change them once or twice a year.

- Report suspected fraud immediately. In the last section, we’ll go over the specific steps to take if you become a victim of identity theft. For now, keep in mind that time is of the essence when it comes to fraud and identity theft.

Popular Identity Theft Scams to Look Out For

Every year, the IRS publishes its “Dirty Dozen” list of the worst tax scams. Check out the 2018 list and stay alert throughout the year, especially between January-April.

Skimming devices, which read the information on your credit or debit card, are another tried-and-true identity theft scam. You can find them on ATM machines, card readers at the cash register, and gas pumps. Never insert your card into a device that looks tampered with.

In the market for a new mobile phone or laptop computer? Beware of websites advertising deals that seem too good to be true. They probably are. Scammers create websites just to bait search engine users who are looking for the best price on popular products. If you visit the fake site, you’ll be asked for your personal information in order to redeem the offer.

Identity thieves also use the bait-and-switch method over the phone. You can set up a fraud filter on incoming calls to avoid answering potential scams. If you do, never give out personal information⸺not for a free cruise, sweepstakes check, or anything else “irresistible.”

What to Do if Your Identity is Stolen

Being a victim of identity theft is a terrible experience, but there are things you can do to resolve the situation as quickly and efficiently as possible. Here are our tips for reporting scams and fixing your credit history.

- Call your bank and credit card companies immediately to cancel stolen cards and set up a fraud alert on your account.

- File a report with your local police station.

- Contact the fraud units of the three credit reporting companies. You can also place a fraud alert online.

- You may want to place a security freeze on your credit report, which will stop lenders from issuing a credit to anyone using your identity. This will also stop you from opening new credit accounts, but you can always lift the freeze when you’re ready.

- Keep a record of all of your fraud-related communications with company representatives, police officers, etc. You may need to refer to this information later on.

- Report your identity theft to the Federal Trade Commission (FTC) by calling 1-877-ID THEFT (1-877-438-4338) or visiting ftc.gov/idtheft.

- Read the Fraud Victim Bill of Rights granted by the Fair Credit Reporting Act. Among other things, you can repair your credit history by blocking negative information related to identity theft from appearing on your credit report.

F&M Bank is Your Local Partner in Identity Theft Prevention

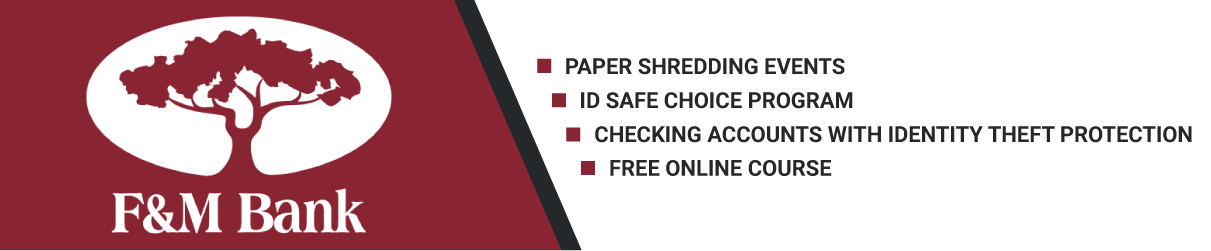

As your Shenandoah Valley community bank, we offer many resources to help our customers protect themselves against the growing threat of identity theft. In addition to our paper shredding events you can sign up for F&M Bank’s ID Safe Choice Program, take advantage of the free Identity Theft Protection that comes with our Cash Reward and Cash Back Checking Accounts, and take the free “Safeguard Your Identity” course in our community classroom.

The Shenandoah County Chamber of Commerce also offers periodic Identity Theft workshops⸺check their calendar for upcoming events. For more local resources, the Harrisonburg Police Department offers Identity Theft and Crime Prevention tips.

Remember that F&M Bank will never ask for your account or login information. Contact us right away if you have questions or concerns about your checking or other accounts.

Best Money Apps for Kids

Best Money Apps for Kids