Handling Market Volatility

Conventional wisdom says that what goes up must come down. But even if you view market volatility as a normal occurrence, it can be tough to handle when your money is at stake. Though there’s no foolproof way to handle the ups and downs of the stock market, the following common-sense tips can help.

Don’t put your eggs all in one basket

Diversifying your investment portfolio is one of the key tools for trying to manage market volatility. Because asset classes often perform differently under different market conditions, spreading your assets across a variety of investments such as stocks, bonds, and cash alternatives has the potential to help reduce your overall risk. Ideally, a decline in one type of asset will be balanced out by a gain in another, though diversification can’t eliminate the possibility of market loss.

One way to diversify your portfolio is through asset allocation. Asset allocation involves identifying the asset classes that are appropriate for you and allocating a certain percentage of your investment dollars to each class (e.g., 70% to stocks, 20% to bonds, 10% to cash alternatives). A worksheet or an interactive tool may suggest a model or sample allocation based on your investment objectives, risk tolerance level, and investment time horizon, but that shouldn’t be a substitute for expert advice.

Focus on the forest, not on the trees

As the market goes up and down, it’s easy to become too focused on day-to-day returns. Instead, keep your eyes on your long-term investing goals and your overall portfolio. Although only you can decide how much investment risk you can handle if you still have years to invest, don’t overestimate the effect of short-term price fluctuations on your portfolio.

Look before you leap

When the market goes down and investment losses pile up, you may be tempted to pull out of the stock market altogether and look for less volatile investments. The modest returns that typically accompany low-risk investments may seem attractive when more risky investments are posting negative returns.

But before you leap into a different investment strategy, make sure you’re doing it for the right reasons. How you choose to invest your money should be consistent with your goals and time horizon.

For instance, putting a larger percentage of your investment dollars into vehicles that offer asset preservation and liquidity (the opportunity to easily access your funds) may be the right strategy for you if your investment goals are short term and you’ll need the money soon, or if you’re growing close to reaching a long-term goal such as retirement. But if you still have years to invest, keep in mind that stocks have historically outperformed stable-value investments over time, although past performance is no guarantee of future results. If you move most or all of your investment dollars into conservative investments, you’ve not only locked in any losses you might have, but you’ve also sacrificed the potential for higher returns. Investments seeking to achieve higher rates of return also involve a higher degree of risk.

Look for the silver lining

A down market, like every cloud, has a silver lining. The silver lining of a down market is the opportunity to buy shares of stock at lower prices. One of the ways you can do this is by using dollar-cost averaging. With dollar-cost averaging, you don’t try to “time the market” by buying shares at the moment when the price is lowest. In fact, you don’t worry about price at all. Instead, you invest a specific amount of money at regular intervals over time. When the price is higher, your investment dollars buy fewer shares of an investment, but when the price is lower, the same dollar amount will buy you more shares. A workplace savings plan, such as a 401(k) plan in which the same amount is deducted from each paycheck and invested through the plan, is one of the most well-known examples of dollar-cost averaging in action.

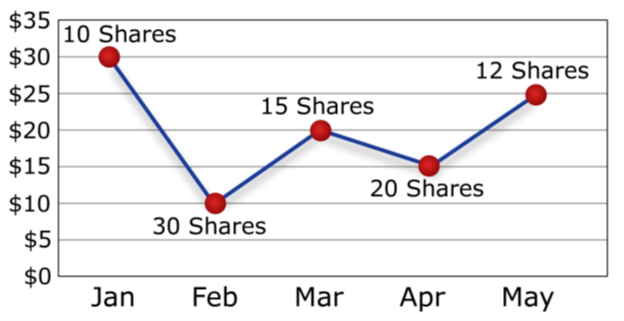

For example, let’s say that you decided to invest $300 each month. As the illustration shows, your regular monthly investment of $300 bought more shares when the price was low and fewer shares when the price was high:

Although dollar-cost averaging can’t guarantee you a profit or avoid a loss, a regular fixed dollar investment may result in a lower average price per share over time, assuming you continue to invest through all types of market conditions.

(This hypothetical example is for illustrative purposes only and does not represent the performance of any particular investment. Actual results will vary.)

Making dollar-cost averaging work for you

- Get started as soon as possible. The longer you have to ride out the ups and downs of the market, the more opportunity you have to build a sizable investment account over time.

- Stick with it. Dollar-cost averaging is a long-term investment strategy. Make sure you have the financial resources and the discipline to invest continuously through all types of market conditions, regardless of price fluctuations.

- Take advantage of automatic deductions. Having your investment contributions deducted and invested automatically makes the process easy and convenient.

Don’t stick your head in the sand

While focusing too much on short-term gains or losses is unwise, so is ignoring your investments. You should check your portfolio at least once a year —more frequently if the market is particularly volatile or when there have been significant changes in your life.

You may need to rebalance your portfolio to bring it back in line with your investment goals and risk tolerance. Rebalancing involves selling some investments in order to buy others. Investors should keep in mind that selling investments could result in a tax liability. Don’t hesitate to get expert help if you need it to decide which investment options are right for you.

Don’t count your chickens before they hatch

As the market recovers from a down cycle, elation quickly sets in. If the upswing lasts long enough, it’s easy to believe that investing in the stock market is a sure thing. But, of course, it never is. As many investors have learned the hard way, becoming overly optimistic about investing during the good times can be as detrimental as worrying too much during the bad times. The right approach in all kinds of markets is to be realistic. Have a plan, stick with it, and strike a comfortable balance between risk and return.

Contact us today for an assessment.

Calan Jansen

Vice President at F&M Bank

Osaic Institutions Financial Advisor with F&M Financial Services, Inc.

Prepared by Broadridge Investor Communications Solutions, Inc.

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. F&M Financial Services is a trade name of F&M Bank. Osaic Institutions and F&M Bank are not affiliated.

Securities and Insurance Products:

Not Guaranteed by the Bank | Not FDIC Insured | Not a Deposit | Not Insured by Any Federal Government Agency | May Lose Value Including Loss of Principal