When it comes to student financial advice and new graduate money management, plenty of books, articles, and websites have been written about the dos and don’ts of personal finance for the under-30 crowd. But you’re a busy college student–who has the time to read all of the info out there and sort fact from fiction? Trust your local Shenandoah Valley community bank to narrow the scope of advice to the best financial tips for students. We’ve kept this guide short enough to read and specific enough to use. Check it out so you can identify the best financial decisions for college students and recent grads and avoid costly money mistakes.

Ignoring Living Expenses

Do you feel like renting is just throwing your money away? Buying your first home may seem impossible or far off, but it doesn’t have to be. Here in Virginia’s Shenandoah Valley, there are state and federal homebuyer assistance programs, as well as other options to make it easier for you to become a homeowner. Instead of making someone else’s investment pay off, you can invest in yourself. And while rents can only go up, a fixed rate mortgage guarantees you’ll have the same monthly home payment as long as you live in the house. Check out our Mortgage and Home Loans page for more info on home financing in the Shenandoah Valley.

Homebuyer Assistance From The Virginia Housing Development Authority (VHDA)

First-time homebuyers in Virginia can get help with their down payment and closing costs through VHDA’s two options:

- The Down Payment Assistance Grant provides funds for your down payment as a gift that doesn’t need to be repaid.

- The VHDA Plus Second Mortgage is a 30-year fixed rate loan. Qualified buyers can borrow up to 1.5 percent more than the sales price, effectively reducing or eliminating the need for a down payment and closing costs. It can also make your monthly mortgage payments more affordable.

Federal Homebuyer Programs

In addition to these state-level programs, several federal agencies administer homebuyer assistance programs.

- FHA Loans: These home loans are insured by the Federal Housing Administration, making it easier for first-time buyers and others to get a mortgage. FHA Loans usually have a lower down payment requirement than conventional home loans, which is helpful for students or recent college grads who want to buy a home but don’t have a lot saved to put down.

- VA Loans: Guaranteed by the U.S. Department of Veterans Affairs, these home loans cover up to one hundred percent of the purchase price, so no down payment is required. Eligibility is limited to U.S. Veterans, Service Members, and certain spouses. If you are a recent grad who served or is currently serving in the military, a VA Loan is a great way to buy your first house.

- USDA Loans: Available as guaranteed or direct loans, from the U.S. Department of Agriculture, these home loans are available to buyers who meet income and rural area requirements.

Family Assistance

If you can’t get a mortgage loan on your own, perhaps a parent or other family member can help. There are several options for family members who want to assist a college student or recent grad with a home purchase.

- Down Payment Gift: If you can qualify for the loan itself but don’t have down payment money, a family gift might be all you need to make homeownership a reality. The giver simply needs to provide a gift letter. Anything up to $14,000 per recipient per year meets the threshold of the IRS’s gift tax exclusion.

- Family Loan: If a parent or other relative has enough asset liquidity to purchase the house themselves, they can be your mortgage lender. This is mutually beneficial, allowing the lender to earn interest and making it possible for borrowers with non-traditional employment or other excluding factors to purchase a home.

- Mortgage Co-Borrower: Also known as co-signing on the mortgage, this option allows parents to help a child become a homeowner without gifting money.

The Investment Property Approach

As the cost of tuition and on-campus living expenses increase, many families are looking at alternatives to paying for traditional room-and-board. For example, some parents buy a home or condo near their child’s college as an investment property. The child can live there, rent-free or not, during their student years. Parents can generate income by renting out a room to another student or purchasing a duplex and renting out one of the units. After the child graduates from college, the family can decide what to do next. The child may want to buy the home from their parents or the parents can keep it as an investment property or sell it. Even recent graduates can take this approach to home buying by renting out a room to a housemate.

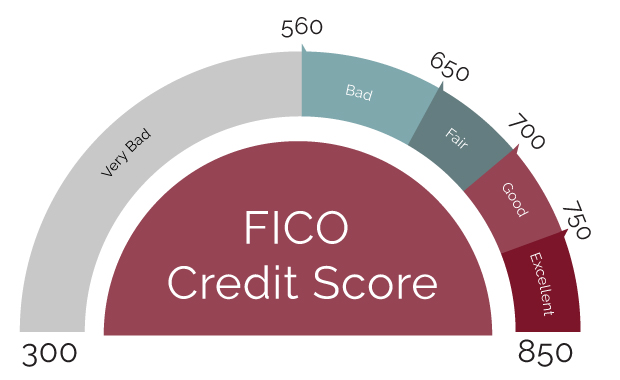

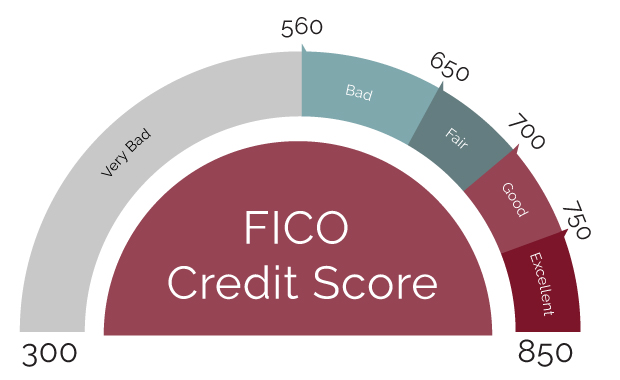

Ignoring Your Credit Score

If you’re like most college students and recent grads, your credit score is probably the last thing on your mind. However, access to credit becomes more important the further you get into adulthood. With no credit history or a low score, it’s much harder (and sometimes impossible) to get a car loan, credit card, mortgage, and other types of financing. A high credit score also results in lower interest rates, so you pay less for the amount borrowed. And people–landlords and employers, for example–often use your credit score as a way to assess your overall trustworthiness. That’s why now is the time to build your credit score or rehabilitate a damaged one.

How To Build Your Credit Score

Before the age of 18, your credit history is a “tabula rasa” (blank slate). Once you open a credit card account or put a utility bill in your name, you start to build credit history and (hopefully) a good score. Federal law entitles you to a free annual credit report from each of the three major agencies (Equifax, Experian, TransUnion). Take advantage of this service to ensure all information is correct and see what lenders who check your credit will see.

The primary ways to build a high score are to open a variety of accounts (credit as well as utility bills), make on-time payments every month, and maintain a healthy debt-to-credit limit ratio. So, a freshman in college might become an authorized user on a parent’s credit card and put their cell phone bill in their own name, regardless of who is paying it. Once you move to your own apartment, put at least one of the utility bills in your name if you’re sharing with roommates. At age 21 it becomes easier to get your own credit card. The key, of course, is not to charge more than you can repay. You might use the card to make just one purchase a month and pay it back on time–that simple act will help you build a good credit score. And of course, if you have student loans, work with your lender to create a repayment schedule you can afford. On-time student loan payments will also build your credit score.

How To Rehabilitate a Low Score

Sometimes youthful follies are harmless, but occasionally they leave lasting repercussions such as a low credit score. If you racked up credit card debt and didn’t pay it, ignored your student loan after graduating, or any number of other credit-destroying acts, you’ll need to devote time and energy to rebuilding your credit score. One good place to start is your local community bank, like F&M. Smaller banks are generally more willing to work with people who don’t have perfect credit. You may be able to open a secured credit card or take out a small personal loan as a first step to filling your credit report with positive records.

You may also need infrastructure to help you budget and pay bills on time. Credit Karma and Credit Sesame are free apps that help you track your credit score–a good motivator when you’re trying to improve it.

Ignoring Your Student Loan

We’ve touched on student loans briefly in the previous section as a way to build or break your credit score. One of the reasons it’s so important to be proactive about student loan debt is that it’s all but impossible to get rid of. Unless you qualify for a federal student loan forgiveness program or find yourself in a rare situation such as the closure of your alma mater, the only way out is through death. Unlike credit accounts, student loan debts are almost never forgiven in bankruptcy proceedings. And even if you qualify for loan forgiveness or cancellation, you’ll need to make payments until then.

The bottom line? Minimize the amount you borrow while in school and take steps to pay down your student loan as soon as possible, even before you graduate. Remember that unless your loan is federally subsidized, it accumulates interest even while you’re still in school. So even making small payments can help to keep the balance down.

Another important action is to use student loan funds ONLY for school expenses. That’s right–you can borrow more than the cost of tuition but you really shouldn’t. Get a part-time job to cover additional living expenses or live at home if possible. Whatever you do, don’t use a student loan “refund” for entertainment expenses or unnecessary purchases.

Finally, take advantage of the Internet to find and apply for scholarships and grants online through tools like Scholly. After you graduate, contact your lender to work out a repayment plan you can afford and don’t go into forbearance. Also, avoid student loan refinancing, which can add to your balance even though it promises a better interest rate.

Ignoring Free Money

One of the best pieces of financial advice for new graduates is to not leave money on the table. When you get your first full-time job after college, be sure to sign up for any retirement accounts your employer offers, like a 401(k). While some money will come out of your paycheck, your employer will also contribute “free money” to your account. The same thing goes for health savings accounts (HSAs) and other employee benefits.

While still in school, take advantage of any student discounts you encounter. Often, all you need is a valid ID. These savings may range from movie tickets and discounts at restaurants and museums, to Amazon Prime free shipping and a lower price on an Apple computer. What they all have in common is free money.

When it comes to personal finance, make sure all of your accounts pay interest or rewards. In other words, put your money to work to make more money. For example, F&M offers cash-back or interest-earning checking account options as well as a rewards credit card.

One last way to ignore free money is to hold onto things you no longer need. Use Craigslist, Facebook Marketplace, and old-fashioned yard sales to exchange furniture, textbooks, and other unused stuff for cash.

F&M Is Invested In The Success Of Local Students

From James Madison in Harrisonburg to other regional schools like Bridgewater College, Lord Fairfax Community College, Blue Ridge Community College, Eastern Mennonite, Mary Baldwin, American National University, F&M cares about the success of our local students. That’s why we give out annual scholarships to students at Lord Fairfax and Blue Ridge Community Colleges, offer summer internships for students interested in learning more about the banking industry, and employ 22 alumni from area colleges (including former interns). We also engage in on-campus events, such as the Bridgewater College business expo, to familiarize students with local companies who are looking to hire college graduates. For more student financial advice and to learn more about the services we offer, contact us today or visit your nearest branch in Harrisonburg, Staunton, and across the Shenandoah Valley.

Best Money Apps for Kids

Best Money Apps for Kids