Archive for year: 2021

Owning vs. Leasing Commercial Real Estate in Virginia

After finding the right property for your business, how do you decide whether to buy or lease it? There are pros and cons with both options, including the opportunity to build equity and profit off the future resale of your commercial real estate property. Keep reading for a complete guide to owning vs. leasing commercial real estate so you can make the best decision for your business. As always, our business banking team is here to help if you have questions!

Pros and Cons of Renting Commercial Real Estate

Let’s start with the benefits of renting a space for your business:

- No down payment, just need a security deposit and first month’s rent

- Usually cheaper on a month-to-month basis, including fewer expenses for upkeep

- Flexibility to move after lease is up if you outgrow the space or want to be in a newer building

- Get the most desirable location possible, even if it’s not for sale

- Easier accounting since your rented space is just a monthly expense, not an asset or liability

On the other hand, you need to consider these potential drawbacks:

- You won’t build equity or benefit from capital appreciation if the property value rises

- Rent is a monthly expense forever, whereas a commercial mortgage can eventually be paid off

- You may be responsible for certain upkeep expenses on some leases

- Rent may increase annually or with each new lease

- No opportunity to earn passive income by renting out part of your space to others

Buying Commercial Real Estate: Pros and Cons

Thinking that buying might be the way to go? Here are the benefits you stand to reap:

- Equity increases over time and the asset value appreciates

- Potential tax benefits and breaks for interest, depreciation, and other expenses

- More control over the property and design or renovation decisions

- Potential for renting out to other businesses

- Improvements to the building and property add value for your business as the owner

- Fixed mortgage payments as opposed to your rent potentially changing

On the other hand, owning may come with more expenses and responsibility:

- Need enough cash upfront for a down payment, closing costs, and other fees

- Can be hard to qualify for commercial real estate financing

- Have to budget for the ongoing costs of upkeep

- Less flexibility since you’re tied down to the location

- Liability

Tips for buying commercial property

If you’ve only purchased residential property before, you’ll want to work with an experienced commercial real estate agent and ask questions throughout the process. Commercial real estate is a different animal from buying a home to live in, but once you understand how it works and the different terminology, you’ll be an expert in no time.

- Some of the best commercial properties are not necessarily listed, which is why working with an experienced commercial real estate agent is so important.

- Talk to your real estate agent at the beginning to be sure you understand how the buying process works and what information you’ll need to provide along the way.

- When you’re ready to start the buying process, also talk to us about financing for your commercial real estate property. We can walk you through the steps and paperwork required to apply for a commercial real estate loan.

- As you look at different properties, consider zoning, closing costs, tax issues, and environmental conditions.

- If the building already has tenants, you’ll need to negotiate with the current owner/landlord over assignments of existing leases and delivery of current rents due. You’ll also want to obtain copies of the rent rolls and existing leases to make sure that neither the tenant nor seller is in default and that there is no past-due rent.

- Negotiating with commercial landlords can be challenging. They can look to keep some legal tricks hidden from you: https://www.dietzlawfirm.com/commercialleasesecrets.htm

Contact us with all your CRE needs and questions!

Wherever your business is headed, F&M wants to help you get there. As a trusted community bank, we understand local business like no one else and believe that one business’s success contributes to the success of the entire business community. For more help with the buying process, F&M Bank is here to be your local commercial real estate expert in Virginia. Real estate is a local business, so when you’re looking for a commercial land loan or other type of commercial real estate loan in Augusta County, you want to work with a local bank who knows the market. Call us today to discuss your business goals and we’ll help you reach them with flexible financing options.

How to Protect Seniors Against Cybercrimes and Scams

| Many of the crimes that occur in real life happen on the internet too. Credit card fraud, identity theft, embezzlement, and more, all can be and are being done online. Seniors and the elderly are often targeted for these cybercrimes. They tend to be more trusting than younger people and usually have better credit, and more wealth. This makes them more attractive to scammers. Seniors are considered easy targets by criminals because they might not know how to report cybercrimes against them. In some cases, seniors can experience shame and guilt over the scam. They may also fear that their families will lose trust in their ability to continue to manage their own finances. | |

Cybercrimes Targeting Seniors |

Here are some common cyber scams used against senior citizens and how to avoid them:

Tech support scam: Criminals pose as technology support representatives and offer to fix non-existent computer issues. The scammers can gain remote access to victims’ devices and their stored sensitive information. Government impersonation scam: Criminals pose as government employees and threaten to arrest or prosecute victims unless they agree to provide payments. Financial scam: Criminals target potential victims using illegitimate credentials from legitimate services, such as reverse mortgages or credit repair. Romance scam: Criminals pose as interested romantic partners on social media or dating websites, particularly targeting women and those who are recently widowed. A new twist is to use the romance scam to recruit victims for other illegal activity. This could include using the victim’s bank account to launder illegally obtained money or apply for benefits in another person’s name. Institutions may become suspicious, especially if these transactions are out of character. They may close the victim’s account, or even refer the account for prosecution, putting the senior citizen at risk for legal action. |

Tips to Protect Seniors Against Cybercrimes |

Here are some tips on how to protect yourself or someone you love from cybercrimes:

If you use social media, limit the amount of personal information you post and only add people that you know. Resist the scammer’s urge for you to act quickly. Scammers are very skilled at manipulating emotions and will fabricate an emergency to persuade a victim to act without thinking. Search for information about the proposed offer and any contact information given by the scammer. There are people and agencies online or in your community who can tell you if an individual or business is a scam. Never be afraid to ask other people for help. Never send money or personally identifiable information to unverified people or businesses. Be suspicious about anyone who demands gift cards as payment. Use reputable antivirus software and firewalls and make sure you regularly update them. If possible, configure your device to automatically download and install updates. Disconnect from the internet and shut down your device if you see unusual pop-ups or get a locked screen. Pop-ups are often used by criminals to spread malicious software. Be cautious what you download. Never open email attachments from someone you don’t know. |

What to Do if You’re Targeted by a Scammer |

If you think you are being targeted by a scammer:

Never share financial account information, and do not allow anyone access to your accounts. Monitor your accounts and credit for unusual activity, such as large sums of money that you did not deposit or loans that you did not apply for. Contact your local law enforcement agency to file a report and notify your financial institutions. |

| Sources | https://www.fbi.gov/scams-and-safety/common-scams-and-crimes/ elder-fraudhttps://www.cisa.gov/publication/stopthinkconnect-older-american-resourceshttps://cybersecurityventures.com/3-cyber-fraud-tactics-targeting-seniors-and-why-theyre-so-effective/ |

F&M Financial Service Advisors Calan Jansen and Matt Robinson Earn Top 50 Ranking by Infinex Investments, Inc

Press Release

For Immediate Release

June 22, 2021, Timberville, VA ‐‐ F&M Bank Corp. is pleased to announce that F&M Financial Services Advisors Calan Jansen and Matt Robinson have both been ranked among the Top 50 Infinex Financial Professionals, based on 2020 Gross Dealer Concession (GDC).

Calan Jansen, who provides investment services to clients in the Broadway and Edinburg offices of F&M Bank, ranked #14 of 50. Matt Robinson, who serves Harrisonburg and Rockingham County from his Cross Keys Road office, ranked at the #48 spot. The Top 50 producers were announced at a virtual ceremony held by Infinex Investments, Inc., in late May.

Securities offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC. Farmers & Merchants Financial Services, Inc. is a subsidiary of Farmers & Merchants Bank. Infinex is not affiliated with either entity.

Securities and Insurance Products:

| Not Insured by FDIC or any Federal Government Agency | May Lose Value | Not a Deposit of or Guaranteed by the Bank or any Bank Affiliate |

About Infinex Financial Group

In 2018, Infinex celebrated its 25th anniversary as an independent broker/dealer focused on serving the investment, insurance and wealth management needs of financial institutions. Currently, Infinex supports over 230 community-based programs and more than 800 financial professionals. The firm, headquartered in Meriden, Conn., with offices in Napa, Calif., and Midlothian, Va., has a unique history of being formed by financial institutions and owned by financial institutions. To learn more about Infinex Financial Group, visit www.infinexgroup.com.

About F&M Bank

F&M Bank (FMBM) proudly remains the only publicly traded organization based in Rockingham County, VA, and since 1908, has served the Shenandoah Valley with full-service branches and a wide variety of financial services including home loans through F&M Mortgage and real estate settlement services and title insurance through VSTitle. Both individuals and businesses find the organization’s local decision-making, and up-to-date technology provide the kind of responsive, knowledgeable, and reliable service that only a progressive community bank can. F&M Bank has grown to $1 billion in assets with more than 175 full and part-time employees. Its conservative approach to finances and sound investments, along with excellent customer service, has made F&M Bank profitable and continues to pave the way for a bright future.

###

2021 Guide to Owning a Modular Home in the Shenandoah Valley

If you’re reading this, you’re probably interested in modular homes. Maybe you already know you want to build one or you’re still in the information-gathering stage. Wherever you are in the process, we cover it all in this exhaustive guide. From the benefits of owning a modular home, to what the process looks like, how to obtain financing, and more–F&M Mortgage’s friendly team of knowledgeable advisors is here to help. Our company has a division dedicated to modular construction financing and we have extensive local experience helping Shenandoah Valley residents build modular homes.

In this article, you will also find answers to frequently asked questions from local advisors and builders. If you have additional questions as you read, give us a call!

Modular Home Benefits

Modular Homes offer endless new home designs and most factories will allow you to use your customized plans, which is why modular is a popular way to build a home.

According to the Washington Post, modular homes have many admirers, including top architects and celebrities like Robert Redford. Among everyday home buyers, time is one of the most attractive benefits of going modular. Because the modules are constructed in a factory, the entire process is shorter than traditional construction. Additionally, modular home factories aren’t subject to weather and labor-related delays. Here are some more modular home benefits:

- Factory Construction: Modular is just another way to build your home! Individual modules are built in a factory and assembled on site. This could save time and money. It also means the interior of your home is not exposed to the elements, reducing the risks of mold and mildew. Site-built homes are built almost entirely outside on your lot or piece of land.

- Permanent Foundation: Similar to site-built homes you can build your modular home on a basement or crawl space.

- Endless Design Possibilities: Choose from your builder’s catalog of home plans, add modifications to suit your needs, or ask about your customized home plans.

- Appearance:Your modular home doesn’t have to have a “generic,” rectangular or box look. Instead, you can choose from traditional architecture styles and models like Cape Cod, Ranch, Two-Story, Colonial, Victorian, and more.

- Quality: Modular construction is subject to its own rules and building codes, which may often be stricter than site-built construction. You can expect the highest quality and safety standards. Your modular home will also be inspected during the construction and after assembly to ensure compliance with local codes and ordinances. It will then be inspected by a state building inspector.

- Energy Efficient: Many articles about modular homes tout the environmentally friendly construction process, which results in less waste than site-built construction. That may not be your top priority, but you’ll appreciate the cost savings on utility bills that modular homes often deliver. Because they are built so solidly, they can be more energy efficient than older homes as well as new site-built construction.

- Cost: Because the factory-built process is more streamlined, with labor and materials already supplied, you can usually avoid the surprise expenses that often accumulate with site-built construction.

- Real Estate Value: Modular and site-built homes are indistinguishable in appearance and both hold their appraisal value. Of course, fluctuations in your local real estate market can drive values up or down, but the modular nature of your home won’t be a factor.

- Financing: Obtaining a loan for your modular home is usually as easy as a site-built home or purchase of an existing home. What’s different about modular and what construction lenders like is the limited risk of the build. Since most of the work is done in the factory and inspected, less can happen during the construction period and build of the home. It is important that a lender has a history of providing construction loans since there are a few more moving pieces than a home already built on a lot or in a development. The difference in new construction and what some say end loan or purchase loan, is that you may buy the land, design and build your home using a construction loan before it is really financed into a traditional mortgage loan. F&M Mortgage makes it easy with our unique modular programs. Find the perfect spot, land or piece of property, pick your design or home style and start your construction loan today. We work with your builder to make the entire process as smooth as possible.

Costs

Of course, one of the biggest questions you’ll have when considering a modular home is how much it costs. According to HomeAdvisor, the national average is $240,000 for modular construction, with an overall range of $180,000-$360,000. You can enter your zip code and project details to get a more specific estimate. Harrisonburg-based Valley Homes offers free quotes when you know the style of your home, type of foundation, interest in adding a covered porch or deck, and garage. Here’s a complete list of factors that could contribute to the total cost of your modular home.

- Land: As with new construction, you need to own the land or maybe you have land from family where your modular home will be assembled. If you don’t already have a lot or piece of land, you’ll need to buy one. According to a Zillow search of land for sale in the Harrisonburg area, most lots are priced between $100,000-$200,000.

- Site Improvements and Permits: Your builder and his contractors build a contract of costs associated with the development of the land for the home. Not only are they licensed to do so they are up to date on building requirements locally.

- Home Plan: The size of your home and the number of upgrades to the interior and exterior will factor into the total cost.

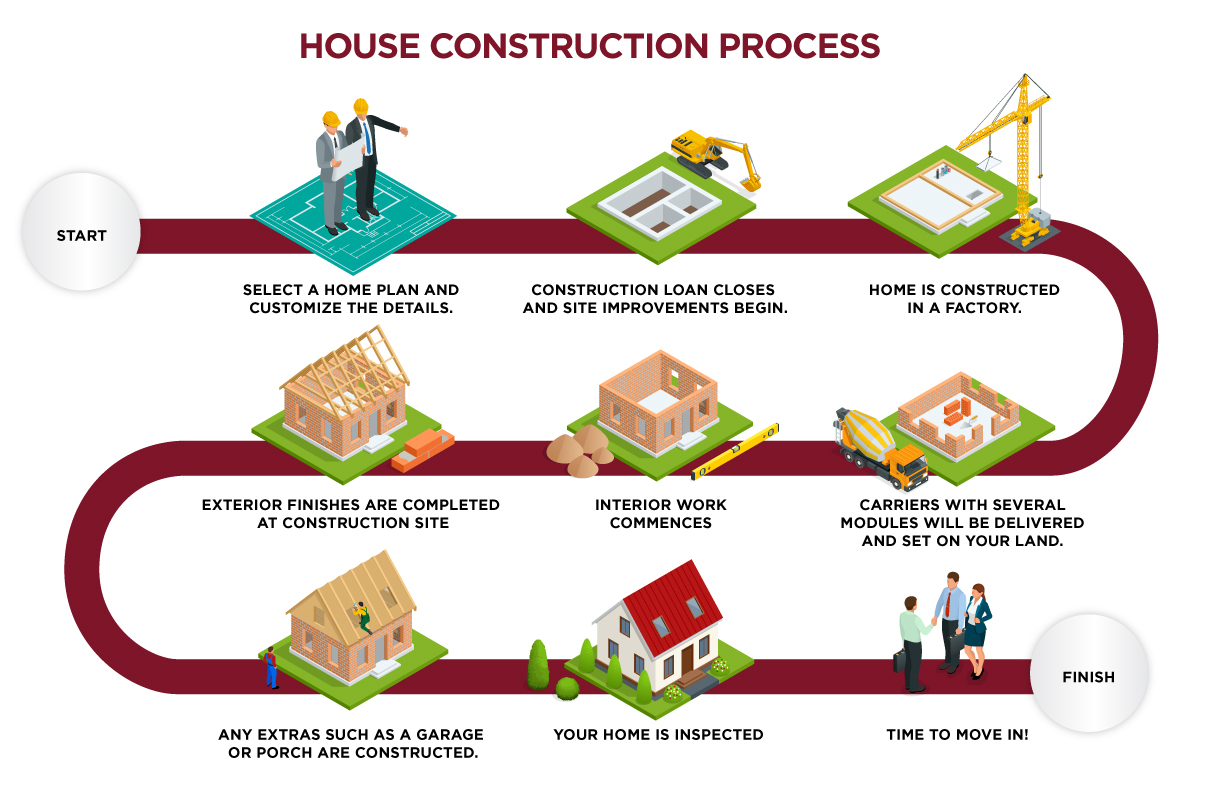

Process

Our guide to Building a Home in the Shenandoah Valley contains information that is also relevant to the modular construction and building process. For example, the section on finding a plot of land is the same, as well as some of the interior work (such as drywall) that happens after your modular home is assembled on site.

Overall, it takes about three-four months from contract signing to move-in readiness. Watch the entire process unfold, from floor plan to finished home, in this video from Valley Custom Homes. Use our checklist below to plan for each step on your calendar:

- Talk to and get approved by a construction loan officer.

- Find and hire your builder.

- Find a piece of land.

- Select a home plan and customize the details.

- Sign a contract with your builder.

- Construction Loan Closes and site improvements begin.

- Home is constructed in a factory.

- Portions of the loan, called draws, are disbursed to pay for work completed.

- Carriers with several modules will be delivered and set on your land, where they are assembled.

- Interior work commences: drywall, electricity, plumbing, and flooring.

- Exterior finishes are finished or some are construction at site.

- Any extras such as a garage or porch are constructed.

- Final Draw is released to builder.

- Your home is inspected and you are granted a certificate of occupancy.

- Final Draw is released to the builder.

- Time to move in!

Questions for an Advisor

What is the difference between construction loans and other home loans?

It’s an entirely different process and risk involved. Construction loans allow you to borrow money before the home is built and funding (draws) is disbursed on completed work to a builder during the construction process. Construction loans allow you to build and make the home yours, and it guarantees new with one owner. Other home loans allow you to borrow money to purchase existing homes.

Does my lot need to be paid off to apply for a construction loan?

A lot loan can be paid off as part of the construction loan. It is actually better to purchase the land at the same time you start your construction loan so you only carry one loan at one time and only have one construction closing. That said, if you do own the lot, construction loans should pay off the lot loan or remainder of what is borrowed at construction closing, to only have one loan.

When in the process is a down payment required for a construction loan?

Most lenders would prefer to have some “skin in the game”, so they will require down payment when the loan closes. If it is a construction to permanent loan, down payment is required at close of the construction loan and before construction begins.

At what point should I consider a construction loan during my home search?

At any point if you have or can find land.

How has the pandemic impacted construction lending?

Prices have increased and materials are more difficult to get. For other home loans, prices are up as well. It is a seller’s market.

Questions for a Builder

Insights from Jesse Rutherford, Protech Home Builder, Custom Modular Homes

What should I consider when deciding to hire a builder?

When a client is asking for specific options or features in the purchase of their new home, it is critical to have a contractor that documents changes and itemizes each particular activity required for the completion of the home. Of course, communication is key! Ask your builder if they utilize an online system to upload documents and facilitate communication. Many builders are adding all comments, documents, contracts, change orders, and the project timeline to an online portal for the client! As we move forward into the 2020s, builders having these available to their client are going to be critical.

What are my responsibilities during the construction process?

Make sure you give your builder as many documents (soil reports), plats, easements (electric, county water, utilities) and requirements (covenants) related to your land as possible. It’s important that we have all the info related to your property so that we can make sure we aren’t missing any details that may come up while building your home!

Do you recommend purchasing a house plan online or working directly with an architect?

I recommend doing what you feel most comfortable with! Most home sales are done directly online. However, with an architect, we can get some specific details down that may be overlooked when selling off of an online version.

Do all decisions need to be finalized before construction begins?

They certainly do not, but you should have 90% of what needs to be done figured out before the construction process begins. If you make too many changes during construction, it could result in a lot of out-of-pocket money for change orders!

On average, how long does the construction process take?

We try to start the foundation 30 days before the home is complete from the factory. After that, there aren’t too many complex items, and it typically takes around 90 days to finish. Of course, this is always contingent on weather, labor, and supply availability as well as building official requirements.

How has the pandemic impacted the construction process?

It has never been a better time to buy a home than today! Interest rates are at all-time lows, and it is hard to get much closer to 0%. The main impacts are time frames of supply. We often find ourselves making sure that certain materials are purchased well in advance because of the backlog, but homes across the commonwealth are going up every day!

Insights from Paul Sofia, Masterpiece Homes of the Carolinas

What should I consider when deciding to hire a builder?

Find out what is included in their pricing and ask about their experience. Address your concerns.

What are my responsibilities during the construction process?

Responsibility lies with the builder during the construction process. The buyer just needs to be patient because it is a process. Delays do happen, especially with weather.

Do you recommend purchasing a house plan online or working directly with an architect?

An architect is extremely expensive. There are thousands of plans online that a manufacturer can duplicate through their engineering department.

Do all decisions need to be finalized before construction begins?

Absolutely, especially when dealing with the agreed price! Changes can be made after the fact if both parties sign an addendum.

On average, how long does the construction process take?

Currently, depending on the manufacturer, 8-12 months.

How has the pandemic impacted the construction process?

Costs have increased as well as turn times.

Insights from Walter Cleaton

What should I consider when deciding to hire a builder?

You should always consider the amount of time a builder has been in construction. Is he licensed and insured to do the work needed? What can your local building official tell you about the builder? A reputable and licensed builder may not always be the cheapest, but should always provide the best work, craftsmanship and experience.

What are my responsibilities during the construction process?

You should take the time to review the home, the options, and all added amenities in person with your builder. Meet with your builder on site, to determine spacing and position of the home. As the buyer, be understanding of weather and unforeseen circumstances, that a builder cannot control. When asked, be prompt in your opinions, documentation, and decision making. Timely communication is the buyer’s greatest responsibility.

Do you recommend purchasing a house plan online or working directly with an architect?

Most plans online will be changed and altered at some point by the buyer. Not all plans online will or can be built to satisfy all codes in every state. If possible, you are usually better served by sitting down with a builder or architect to design your home. Everything done in person is usually better. Nothing beats eye to eye comparison.

Do all decisions need to be finalized before construction begins?

Any decision that can be made prior to construction, and especially a contract, is always better for all parties. Change orders can be discussed and made after construction begins, but if known in the beginning, it will usually save everyone time and money.

On average, how long does the construction process take?

All projects will vary in the time it takes to complete, depending on the size and details of the proposed construction. Weather and the availability of materials can and will play a huge role in the time it takes to complete a project. Basements vs foundations, single story vs two story, etc. Will always be a factor in the time to complete. There is no set time on any project to complete. A builder can only give an approximate timeline, or a worst-case scenario. There is not magical date or timeline that every home should be built or ready by.

How has the pandemic impacted the construction process?

The pandemic has greatly impacted the construction process. Shortages of materials and components, due to depleted work forces, has put the construction industry behind greatly. Companies losing workers due to quarantine has hit the labor force hard. Most construction materials and components have been impacted in some way. The original stockpile of these items have been depleted, and catching up or staying up with demand, with a depleted work force, has caused strain on the construction industry.

Additional Helpful Resources

Ready to start the process of finding a builder and designing your modular home? Here are some local resources.

- F&M Mortgage: professional construction lending experts.

- Protech Home Builder: A custom Modular Home Virginia builder that specializes in highly energy-efficient home at a great value at an affordable price.

- Masterpiece Homes of the Carolinas: Provides both site-built homes and modular homes in Charlotte, NC.

- Shenandoah Valley Builder’s Association: Find reputable local home builders and other home improvement professionals in your community.

- Valley Custom Homes: Harrisonburg-based builder specializing in modular homes.

- Clayton Homes of Harrisonburg: Another local option for modular home construction.

- Pats Manor Homes of Harrisonburg: Another local option for modular home construction.

- ModCoachBlog: a great national resource with articles, updates and who’s who in the modular world of building.

Financing Options

F&M is your local partner in modular home financing. From purchasing a land lot to construction, and an eventual traditional mortgage, we can help you enjoy a smooth financing process from start to finish. Our Approved Builder Modular Construction Loan Program reduces your construction loan costs and qualified borrowers can take advantage of low down payment options. F&M is proud to be an approved lender for federally guaranteed loans such as FHA, VA, USDA, and VHDA. You may be able to use these home loans to finance part or all of your modular home costs. We also offer bridge loans for people who need to finance a new home purchase while waiting for their existing house to sell. Apply online or contact our lending team with any questions you have about modular home financing.

F & M Bank Corp. Announces Record Quarterly Earnings & Reaches $1 Billion In Assets In First Quarter 2021

News and Financials |

F & M Bank Corp. Announces Record Quarterly Earnings & Reaches $1 Billion In Assets In First Quarter 2021

Contact: Carrie Comer, EVP/Chief Financial Officer, (540) 896-1705 or ccomer@fmbankva.com

TIMBERVILLE, VA—April 26, 2021—F & M Bank Corp. (OTCQX: FMBM), parent company of Farmers & Merchants Bank today reported net income available to common shareholders of $3.8 million and diluted earnings per common share of $1.11 for the first quarter ending March 31, 2021.

Record Quarterly Earnings

The bank is reporting record quarterly earnings in the first quarter of 2021 of $3.8 million while continuing to position the company for success over the long term. F&M Bank continues to strengthen its solid financial position with historic levels of liquidity and historically strong capital base as we grew to over $1 Billion in Assets.

“With continued strong asset quality metrics and improved optimism for economic recovery due to COVID-19 vaccines and government stimulus, we believe that credit losses will not be as high as initially anticipated and that loan growth will continue to improve. Coupled with the significant growth in our client base over the past year, we remain optimistic that F&M Bank is well positioned to deliver profitable growth and continue to build long term value for our shareholders,” said Mark Hanna, president and chief executive officer.

Non-Interest Income

Noninterest income increased to $3.4 million for the quarter ended March 31, 2021 from $3.2 million in the prior quarter and $2.4 million in the quarter ended March 31, 2020. Growth is primarily driven by continued high volumes of mortgage originations, growth in our wealth management division, and title division. Volumes in these areas more than offset the decreases in deposit service charges.

Paycheck Protection Program (“PPP”) & CARES Act

During 2021, the Company processed 280 Paycheck Protection Program (PPP) loans that totaled $20.2 million; PPP loans processed during 2020 and 2021 YTD totaled 997 loans for $83.4 million. In addition to an insignificant amount of PPP loan payoffs, the Company has processed a total of $46.4 million of forgiveness on 560 loans program to date resulting in a remaining balance of PPP loans of $37.0 million. The Company is continuing to accept PPP applications, and processing applications for forgiveness.

In addition, we have granted 35 individual loan deferrals in 2021, for a total of 1,266 deferrals since COVID began. As of March 31, 2021, 52 loans remain in deferral with a balance of $11.8 million or 1.7% of total loans.

Waynesboro Branch Opening & Branch Lobbies Reopen

The bank is set to open a new branch in the Waynesboro market on April 26, 2021. This will expand our presence in Augusta County to serve the community’s financial needs with our full suite of branch services. Branch lobbies at all our locations were reopened to the public on April 12, 2021. We will continue to assess our procedures to maintain the safety of our customers, employees, and community as we move forward.

Selected financial highlights for the quarter include:

- Quarterly net income of $3.8 million

- Net interest margin of 3.44%.

- Total deposits increased $44.2 million and $183.4 million, respectively for the quarter and for the trailing 12 months as the bank continues to grow our composition of DDA accounts and decrease balances of Time Deposits.

- Total loans increased $12.8 million for the trailing 12 months (excluding PPP loans).

- Nonperforming assets decreased to 0.57% of total assets at the end of the quarter from 0.68% on 12/31/20 and .66% on 3/31/20.

- Negative Provision for Loan Losses of $725,000

- Allowance for loan losses totaled 1.46% of loans held for investment (1.54% excluding PPP loans).

Mark Hanna, President, commented “We are pleased with first quarter earnings of $3.8 million. Our mortgage and title companies, continue to see volumes in excess of expectations which drives noninterest income growth. Our net interest margin of 3.44% shows a historical decline but remains strong especially given the changes in our balance sheet and the current rate environment. Net interest income reflected a 4% increase over March 31, 2020. F&M’s liquidity has increased significantly over the last four quarters and we are implementing strategic solutions to leverage these assets including deploying $64.2 million into the investment portfolio since year end 2020. Despite the current low-rate environment, these strategies should augment our net interest margin in the future.”

Mr. Hanna stated, “Nonperforming assets have continued to improve, decreasing $754 thousand since year end 2020. We feel these efforts put F&M in a strong position to leverage a more optimistic economic forecast while seeking opportunities for continued growth in the communities we serve.”

On April 21, 2021 our Board of Directors declared a first quarter dividend of $.26 per share to common shareholders. Based on our most recent trade price of $28.19 per share this constitutes a 3.69% yield on an annualized basis. The dividend will be paid on May 31, 2021, to shareholders of record as of May 15, 2021.”

F & M Bank Corp. is an independent, locally-owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank’s eleven banking offices in Rockingham, Shenandoah, Page and Augusta Counties, Virginia. The Bank also provides additional services through a loan production office located in Penn Laird, VA and through its subsidiaries, F&M Mortgage and VSTitle, both of which are located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-1705.

This press release may contain “forward-looking statements” as defined by federal securities laws, which may involve significant risks and uncertainties. These statements address issues that involve risks, uncertainties, estimates and assumptions made by management, and actual results could differ materially from the results contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in interest rates, general economic conditions, legislative and regulatory policies, and a variety of other matters. Other risk factors are detailed from time to time in our Securities and Exchange Commission filings. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

F & M Bank Corp. Key Statistics

(1) The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are nontaxable (i.e. municipal securities and loan income) then subtracting interest expense. The tax rate utilized is 21%. The Company’s net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns nontaxable interest income from municipal loans and securities, net interest income for the ratio is calculated on a tax equivalent basis as described above. (2) The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. The efficiency ratio is a common measure used by the financial service industry to determine operating efficiency. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investments portfolio and Other Real Estate Owned. The Company calculates this ratio in order to evaluate how efficiently it utilizes its operating structure to create income. An increase in the ratio from period to period indicates the Company is losing a greater percentage of its income to expenses.

F & M Bank Corp. Financial Highlights |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

For Three Months Ended March 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INCOME STATEMENT | Unaudited 2021 | Audited 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and Dividend Income | $8,746,348 | $9,110,585 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Expense | 1,068,509 | 1,706,084 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Interest Income | 7,677,839 | 7,404,501 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-Interest IncomeProvision for Loan Losses

Other Non-Interest Expenses |

3,355,044(725,000)

7,685,337 |

2,428,5181,500,000

7,119,604 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Before Income Taxes | 4,072,546 | 1,213,415 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for Income TaxesLess Minority Interest (income)/loss | 271,294 | (38,371) (62,429) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income | $3,801,252 | $1,189,357 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividend on preferred stock | 65.448 | 65,873 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income available to common shareholders | $3.735.804 | $1,123,494 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Common Shares Outstanding | 3,205,074 | 3,204,084 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income Per Common ShareDividends Declared | 1.17.26 | .35.26 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET | Unaudited March 31, 2021 | Audited March 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and Due from Banks | $12,088,442 | $8,528,494 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Bearing Bank Deposits | 1,541,581 | 1,645,590 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Funds Sold | 90,099,000 | 78,944,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans Held for SaleLoans Held for Investment | 15,922,810659,373,490 | 60,765,429609,585,135 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less Allowance for Loan Losses | (9,704,286) | (9,437,359) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Loans Held for Investment | 649,669,204 | 600,147,776 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities | 182,091,328 | 19,838,180 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets | 58,817,489 | 57,597,524 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $1,010,229,854 | $828,466,993 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | $862,751,952 | $679,310,203 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long Term Debt | 32,158,578 | 42,089,286 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Liabilities | 17,791,953 | 15,633,317 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 912,702,483 | 737,032,806 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | 4,558,298 | 4,591,623 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity | 92,969,073 | 86,842,564 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ Equity | 97,527,371 | 91,434,187 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity | $1,010,229,854 | $828,466,993 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Book Value Per Common Share | $28.99 | $27.20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible Book Value Per Common Share | $29.33 | $26.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: F & M Bank Corp.

Contact: Carrie Comer EVP/Chief Financial Officer, (540) 896-1705 or ccomer@fmbankva.com

F&M Bank Opens New Location in Waynesboro, VA

Pictured above: 2020 Calendar Photo entry submitted by Makeba Robinson

NEWS RELEASE

FOR IMMEDIATE RELEASE: F&M Bank Opens New Location in Waynesboro, VA

TIMBERVILLE, VA—April 23, 2021— F&M Bank, a locally owned independent community bank headquartered in Rockingham County is excited to announce the opening of its newest location in Waynesboro, VA on Monday, April 26, 2021. The full-service branch located at 2701 West Main Street expands the $1 billion community bank’s presence to four banking offices in the Augusta County market and 12 offices serving the greater Shenandoah Valley.

“The F&M Bank team is delighted to grow into the vibrant City of Waynesboro – a thriving, local economy,” said Mark Hanna, President & CEO. “With this growth, we remain focused on serving the Shenandoah Valley and contiguous markets as an independent bank for the long-term. The decision to expand into Waynesboro supports our strategic initiative of organic expansion in core markets to better serve the banking needs of our communities.”

In January 2021, F&M Bank entered into an agreement with Carter Bankshares, Inc. to acquire the branch, and associated client relationships, which recently received regulatory approvals. The Company also welcomes two Carter Bank & Trust employees, Lisa Shiflet and Breanna Rodgers to the F&M Bank family.

Mr. Hanna is available for further comment. Please contact Holly Thorne at marketing@fmbankva.com, (540) 217-6409

Carolyn Burnett joins Commercial Banking Team

F&M Bank’s executive leadership is pleased to welcome Carolyn Burnett to its growing commercial team. Carolyn joins F&M Bank as Senior Vice President, Commercial Relationship Manager with a focus in Augusta County.

Carolyn brings a strong background to F&M with a Bachelor of Business Administration in Finance from James Madison University and over 14 years’ experience managing commercial banking relationships. In her role at F&M, Carolyn looks forward to working with business managers to understand their needs and help them to achieve their financial goals.” In her spare time, Carolyn serves on the board of directors for the Center for Nonprofit Excellence and on the loan advisory committee for the Community Investment Collaborative. She is also an active supporter and volunteer for the Blue Ridge Area Food Bank and Habitat for Humanity.

F&M Bank’s President and CEO, Mark Hanna commented, “As an experienced commercial banker serving the Valley market, Carolyn brings a wealth of knowledge and expertise to her role. We are excited to welcome her to our Augusta County team.”

5-Star F&M Bank: A Trusted Community Bank

April 2021: F&M Bank, Timberville, Virginia has been awarded the highest (5-Star) rating for financial strength and stability from the Nation’s Premier Bank Rating Firm, BauerFinancial, Inc. Earning this 5-Star rating is proof that F&M Bank excels in such areas as capital adequacy, profitability, asset quality and much more.

“This is indeed reflective of F&M Bank’s dedication and commitment, not only to its customers, but to the entire community”, reflects Karen Dorway, president of BauerFinancial. “Community banks, like F&M Bank, have been on the front lines doing what is necessary to help their neighbors and friends. This is the type of devotion you will only find in a community bank.”

Established in 1908, F&M Bank has been a trusted ally of the communities it serves for 113 years. Rest assured, 5-Star rated F&M Bank’s personnel are eager to serve: at the branch, by phone and online at fmbankva.com.

F&M Bank: “Your 5-Star Community Bank”

Bank and Credit Union data compiled from financial data for the period noted, as reported to federal regulators. The financial data obtained from these sources is consistently reliable, although; the accuracy and completeness of the data cannot be guaranteed by BauerFinancial, Inc. Since 1983, BauerFinancial has relied upon this data in its judgment and in rendering its opinion (e.g. determination of star ratings). BauerFinancial, Inc. is not a financial advisor; it is an independent bank research firm. No institution can pay for or opt out of a BauerFinancial rating. Star-ratings are all available for free at bauerfinancial.com.