Tax Considerations When Buying and Selling Real Estate

Purchasing real estate—whether for your home or other personal use or as an investment—comes with many complex tax implications. From property taxes you’ll need to pay as part of your mortgage payment to understanding strategies to avoid capital gains on investment property, taxes can make a significant impact on your bottom line or monthly budget.

This article offers some introductory insights to keep in mind when buying and selling real estate, with tips that can help optimize your financial position while navigating the complex terrain of property transactions. Keep reading to learn key insights that can potentially save you money and enhance your real estate investment journey!

Types of Real Estate Transactions

Before we delve into real estate tax considerations, let’s take a moment to review the different kinds of real estate purchases. The kind of real estate and purpose of its ownership can make a drastic difference on the types of taxes you’ll need to pay.

Traditional Sale: What most people think of when discussing buying and selling a home, traditional sales involve two parties (homeowner/sell and buyer), and are usually orchestrated by real estate professionals who represent each party. These sales usually have some kind of contingencies built into the offer, including an inspection of the property and financing approval.

As-Is Sale: When a home is sold as is, there is no warranty and no desire to make repairs or changes—though the buyer may choose to have an inspection for their own informational purposes. Homes sold as is usually either need drastic repairs and updates or the owner needs to sell quickly, without waiting for the usual sales timeline. If purchasing an as-is for rental, you may be able to deduct improvements on future tax bills (we’ll talk about this more later).

Short Sale: In a short sale, the property is sold for less than what the current owner still owes. Short sales are often done by the homeowner in an attempt to sell the property before it’s foreclosed upon by their lending company—with all proceeds going to the lender. Short sales are often as-is. When purchasing a short sale, it’s important to make sure there are no tax liens on the property.

Foreclosure: With a foreclosure, lenders seize a property when homeowners fall behind on their loans, selling to buyers–-sometimes below market value. As with short sales, it’s important to work with a title lawyer to ensure there are no tax liens on the property.

Cash Flow Investment: This kind of investment involves purchasing a property for income, leasing it to bring in cash each month.

Turnkey Investment: Some investments, especially homes that are sold “as is”, will require a lot of work to get them ready to rent out. While buyers will often pay a premium for this, a turnkey property is fully functional and ready to go to lease at closing. In fact, it may already have tenants.

Vacant Land Acquisition: Real estate sales of land are a growing form of investment, whether buying a lot to build a home, land for agricultural purposes, commercial development, or to hold onto for later use or resale.

Tax Benefits of Owning a Home

If you itemize your federal tax deductions (in other words, you don’t simply take the standard deduction) you can deduct:

• Mortgage interest

• Home equity loan interest (if loan is used to make improvements to your residence)

• Property taxes

• Mortgage insurance premiums

Note, for many individuals the standard deduction ($21,900 for married-filing-jointly in 2024) will offer better tax breaks than itemizing, but this will vary from individual to individual.

Additional Tax Benefits of Homeownership

Self-employed and small business owners: If you are a small business owner (including self-employed individuals) and work out of your home regularly, you can claim a home office deduction for a portion of your home. This is a tax reduction for expenses including your mortgage payment, taxes, insurance, repairs, and utilities.

Capital gains tax exclusion: Ready to sell your home? Rest assured that a portion (and in most cases all) of your profits will be excluded from federal income taxes. In fact, you don’t have to pay taxes on the first $250,000 (single) or $500,000 (married) of profit, as long as you lived in your home as your primary residence for 2 out of the last 5 years.

Energy efficiency tax credits: If you make energy-efficient home improvements to your home, you may also receive tax credits for these.

- Energy Efficient Home Improvement Credit: Up to $3,200 (or up to 30% of improvement costs) in qualifying credits in 2024.

- Residential Clean Energy Credit: Credits for up to 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032.

- Additional tax incentives through the Inflation Reduction Act: From upgrading wiring to installing heatpumps, there are additional incentives (rebates and tax credits) available for the electrification and upgrade of your home to increase energy efficiency. Use the calculator on Rewiring America to see what you may qualify for.

Tax depreciation on rental property: Renting out your home? The IRS allows a depreciation rate of 3.636% each year for 27.5 years for most U.S. residential rental property. You can deduct this percentage of your property’s purchase price each year from your taxable income.

Tax credits and deductions can get complicated—especially when it comes to real estate. It’s always best to consult with a tax professional to help you navigate the regulations surrounding these real estate tax benefits to ensure you are documenting and filing your taxes correctly.

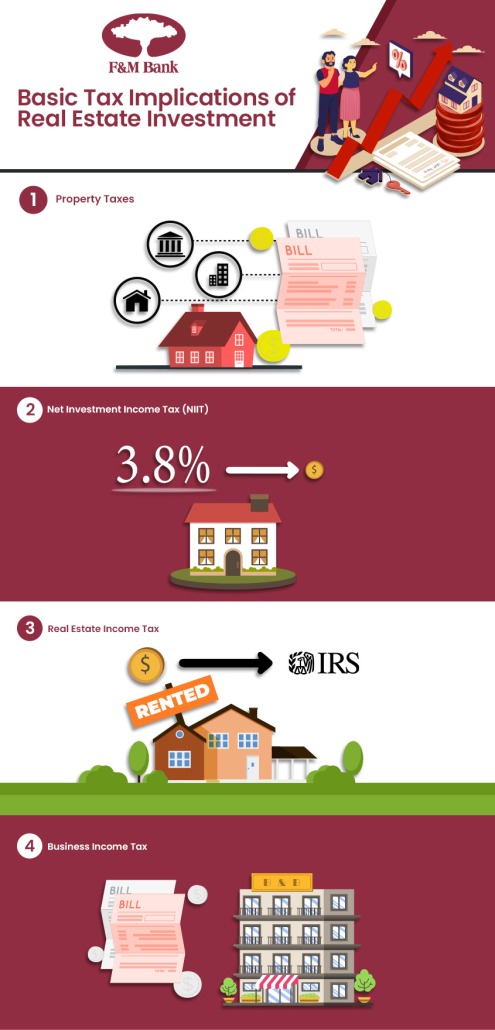

Basic Tax Implications of Real Estate Investment

There are many tax benefits associated with home ownership. But there are also a number of taxes associated with owning a home that are important to keep in mind. These can include:

Property taxes: Based on the property’s assessed value (often about ⅔ of the market value), you may have to pay a number of different property taxes, depending on your municipality, including, school, city/township, and county property taxes. If you have a mortgage, your mortgage company will add a portion to your monthly payment each month to cover annual tax bills.

Net investment income tax (NIIT): Some real estate investing will result in investment income, which requires payment of this special tax of 3.8%.

Real estate income tax: If you rent out real estate, that income must be reported and taxed as regular income.

Business income tax: If you use your residence or property for income purposes, for instance as a bed and breakfast, this income is taxable.

As with homeownership tax deductions and credits, it’s important to consult with a tax professional to be sure your taxes are filed correctly—especially if you are claiming business or real estate income.

Taxes on Investment Property Sales: Capital Gains Tax and 1031 Exchange

While your capital gains on the sale of your residence are often tax free (see above), when you sell an investment property and its sale produces a profit, you will be expected to pay capital gains taxes on the proceeds.

Short-term capital gains (for assets you’ve had less than a year) are taxed as income, and what you pay will depend on your income tax rate. Standard income tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. If you are flipping a home for sale, your income may fall into this category.

Long-term capital gains (for assets you’ve held for more than a year) are taxed using a different system: 0%, 15%, and 20% (depending on your income level and filing status). As the IRS explains, “The tax rate on most net capital gain is no higher than 15% for most individuals,” unless your income is more thab $459,750 if single; more than $517,200 for married filing jointly in 2024.

A 1031 exchange allows real estate investors to defer their capital gains taxes when selling an investment property by letting them use those funds to reinvest into a like-kind property within a specific time frame, by adhering to the IRS guidelines for 1031 exchanges.This tax-deferred exchange strategy can be used repeatedly, potentially allowing investors to accumulate wealth through real estate without immediate tax obligations.

Reach Your Real Estate Goals with F&M Bank

At F&M Bank, we understand our local Virginia real estate markets, and can work with you to find the right financing to achieve your goals, whether it’s owning your first home or growing your investment portfolio. From purchase loans like Investment Property Loans and traditional Mortgages to Home Equity Loans for those energy efficient renovations, we have an assortment of affordable and flexible financing options to meet your needs.

Our experienced lenders can provide effective real estate tax advice as you weigh your options and choose your loan, partnering with your realtor to help ensure a swift and smooth closing. Reach out to us at one of our bank locations throughout the Shenandoah Valley to get started!

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.

We have been made aware of an unsolicited text and phone call scam circulating through our area. Please DO NOT click any links sent to you via text.