Looking for investment help in the Shenandoah Valley? You’ve come to the right place. At F&M Financial Services, we know that investing can feel intimidating when you’re not familiar with the various investment options and terminology. In this article, we’ll cover the basics of building a diversified investment portfolio. From defining common terms to explaining different approaches to investing, you’ll have a better understanding of your investment portfolio. Of course, if you have specific questions or need advice about your portfolio, contact one of our Osaic Institutions Financial Advisors in Harrisonburg, Rockingham County, and Shenandoah County.

Where can I monitor stock values?

Local investors in the Shenandoah Valley can find a real-time market report and see our 14 most popular stocks on the Local Market Dashboard page. Looking for local investing help? Consider investing in local publicly-owned businesses with roots in the Shenandoah Valley. The dashboard provides a bird’s eye view of current share prices on the most popular local stocks, as well as important national indicators such as the Dow Jones Industrial Average, S&P 500, and NASDAQ Composite.

How to diversify your investments

Generally, diversifying* your investment portfolio is a reasonable approach to realizing steady long-term growth of your finances. Understand your various investment options and how they could support your investment goals:

What is a stock?**

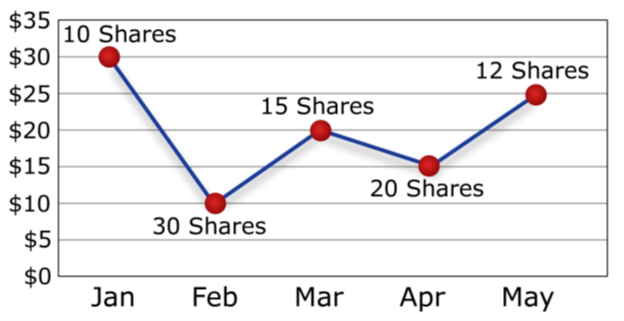

Individual stocks represent a share of ownership in a publicly-traded company. Investors can buy stocks ‘a la carte” in the hope that they will increase in value over time. For example, investors who purchased individual Apple stock in 1980 would have seen their bet pay off very well in the years since, if they held onto it.

However, not every bet pays off and it’s hard to know at the Initial Public Offering which companies will become wildly successful like Apple or Tesla, and which will flame out. That’s why many investors prefer to mitigate the risk of individual stock values by investing in index funds or ETFs.

For example, the Dow Jones is a stock market index tracking 30 of the largest blue-chip companies on the stock exchange. You could choose an ETF (Exchange-Traded Fund) that tracks the Dow Jones. ETFs provide broad market exposure to potentially give your portfolio more stability and less risk.

Similarly, the S&P 500 is a stock market index following 500 of the top publicly traded U.S. companies. You can invest in index funds and ETFs that track the S&P.

Lastly, the Nasdaq Composite Index features stocks that are exclusively listed on the Nasdaq stock exchange. It is more tech-heavy than the Dow or S&P and the total number of stocks in the Nasdaq can change often.

What is a bond?

A bond is a unit of corporate debt that can be traded as an asset. Bonds are considered less risky than stocks to invest in because bonds have a fixed interest rate. However, the trade-off for that stability is usually a lower rate of return. That’s why building a diversified portfolio means having both higher-risk/higher-rate-of-return assets like stocks as well as more reliable/lower-rate-of-return assets like bonds.

What is a Mutual Fund?***

Unlike index funds and ETFs, which are not actively managed and only follow stocks, a mutual fund is defined by the U.S. Securities and Exchange Commission as:

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates.

Because mutual funds already contain a diversified portfolio of stocks, bonds, and short-term debt, buying shares in a mutual fund can be an easy way to diversify your own portfolio.

When it comes to index funds and ETFs vs. mutual funds, one of the main differences is that the cost of management fees tends to be lower for ETFs on average when compared to Mutual Funds. Mutual funds are sold by prospectus only, which may be obtained from a financial professional and should be read carefully before investing. Investors should consider the risks, investment objectives, fees, expenses, and charges disclosed in the prospectus.

CDs, Savings Accounts, and Money Market Accounts

As you approach retirement age, you’ll want to keep a portion of your investment portfolio in a more liquid account where you can earn some interest while having access to the next year or two of cash for living expenses. F&M Bank offers Certificates of Deposit (CDs), Free and Premium Savings Accounts, and Money Market to meet your liquidity needs.

Should I include Real Estate in My Investment Portfolio?

During your investment research, you may have heard of the 20% rule. If you are unfamiliar, the idea is that some investors find value in allocating at least 20% of your portfolio into investments that are outside of the stock market itself. It is popular for many investors to fill this 20% with real estate. This is not a hard and fast rule, however. Some investors may be more comfortable with a smaller or larger percentage of their funds being in real estate. Regardless, it can be a good idea to consider this as a piece of your overall investing strategy. Our financial advisors can help you understand what allocation would be the best fit for you. You also can learn more about F&M Bank’s mortgage lending options to get started with funding a real estate purchase.

Consider Your Risk Tolerance

We’ve covered the risk levels of various investment vehicles such as stocks, bonds, and mutual funds. But you also need to consider your personal tolerance for risk when deciding how much of your portfolio to allocate to different types of investments.

How much time do you have?

Generally, the younger you are the more aggressive you can afford to be with risk. A temporary setback can be overcome with time, while someone close to retirement will want to be more moderate or conservative. However, age isn’t the only factor to consider. Your comfort level with risk, long-term investment goals, and current income are also important.

As a general rule of thumb, a portfolio for each risk level would look like:

- Aggressive: About 80% stocks and 20% bonds

- Moderate: About 50% stocks and 50% bonds

- Conservative: About 20% stocks and 80% bonds

Contact our financial advisors in the Shenandoah Valley to discuss your personal risk tolerance and how to diversify your portfolio accordingly.

Build your investment portfolio with a team you trust!

If you’re looking for Wealth Management services in Virginia, our financial planners guide you through your options for how to invest your money in VA to ensure you understand your investment portfolio and are comfortable with our strategy. Schedule an appointment with an Osaic Institutions Financial Advisor with F&M Financial Services at any of our locations today!

Meet your financial advisor in Edinburg & Broadway, VA!

Meet your financial advisor in Harrisonburg & Staunton, VA!

*Diversification is a method of helping to manage risk. It does not assure a profit or the avoidance of loss.

**Past performance is not a guarantee of future results.

*** Mutual funds are sold by prospectus only, which may be obtained from a financial professional and should be read carefully before investing. Investors should consider the risks, investment objectives, fees, expenses, and charges disclosed in the prospectus. Investment objectives, fees, expenses, and charges disclosed in the prospectus.

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. F&M Financial Services is a trade name of F&M Bank. Osaic Institutions and F&M Bank are not affiliated.

Securities and Insurance Products:

Not Guaranteed by the Bank | Not FDIC Insured | Not a Deposit | Not Insured by Any Federal Government Agency | May Lose Value Including Loss of Principal